The important differences between sponsor-backed and non-sponsor-backed loans

In the wake of increased financial regulations, alternative asset managers have replaced banks as the primary source of corporate loans, with private credit now surpassing $1.4 trillion in global assets under managed1. Investors interested in allocating to private credit should understand the two primary categories: sponsored and non-sponsored backed loans.

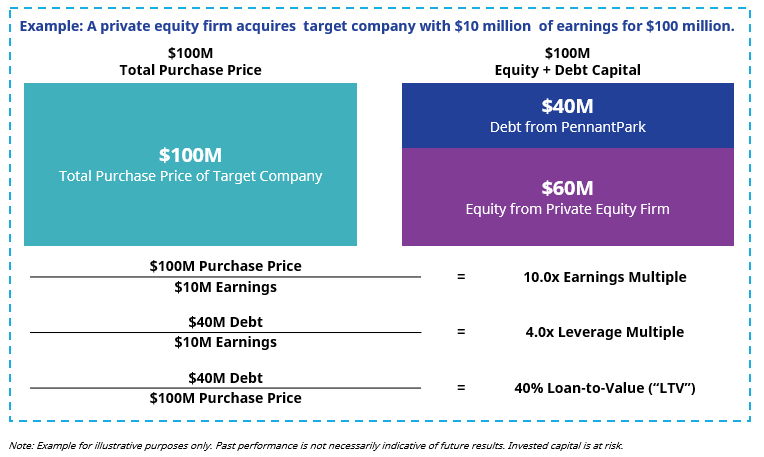

Sponsor-backed loans are loans extended to a business owned by a private equity firm. Typically, with sponsor-backed loans, the private equity firm identifies the lender and helps to negotiate the loan terms between the borrower and the lender. Private equity firms seek lenders to help finance the acquisition more efficiently by adding leverage and, ultimately, improve their rate of return. For lenders, the private equity investment provides additional equity cushion to the corporate capital stack, which protects the lender’s principal, should the company need to be liquidated. Since credit sits higher in the capital stack than equity, the credit manager is first in line to be repaid with any distributions or proceeds. Additionally, as with most sponsor-backed deals, the private equity firm can inject additional equity capital into the company if needed.

1 Understanding Private Credit: Sponsored Vs. Non-Sponsored Financing | September 2023

Non-sponsor-backed loans are loans extended to businesses without private equity backing. In these deals, lenders work directly with the borrowers without any intermediary. These deals are typically small, can be more challenging to source, and have historically been viewed as having more risk given the lack of equity cushion in the capital stack. In sponsor-backed loans, all equity must deteriorate to zero value before a single dollar of the loan is at risk. In non-sponsor-backed loans, the principal is at greater risk given the lack of equity in the capital stack. The graph below shows that non-sponsored loans traditionally have higher payment default rates.

At PennantPark, we focus on core-middle market, sponsor-backed deals. We proudly maintain a broad set of private equity sponsor relationships that provide a proprietary sourcing channel for our deal flow. We cover over 700 middle-market private equity sponsors and have completed transactions with 220+ trusted sponsors. Since 2020, 80% of investments completed by PennantPark have been with repeat sponsors, who have a track record of supporting portfolio companies. We welcome a conversation; please contact invest@pennantpark.com or the professionals listed below.

©2024 PennantPark Investment Advisers, LLC (‘PennantPark’) is an investment adviser registered with the US Securities and Exchange Commission (‘SEC’). Registration is not an endorsement by the SEC nor an indication of any specific level of skill. Products or services referenced in this document may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document, or the merits of the products and services referenced herein. This document and the information contained herein has been made available in accordance with the restrictions and/or limitations implemented by applicable laws and regulations.

In considering the past performance information contained herein, recipients should bear in mind that past performance is not a guarantee, projection or prediction and it is not a guarantee or indication of future results. Invested capital is at risk. There can be no assurance that any product or service referenced herein will achieve comparable results, or that they will be able to implement their investment strategies or achieve their investment objectives.

An investment with PennantPark in any advised fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period. There can be no assurance that any investment will be profitable, not lose money, or achieve the other intended purposes for which they are made. Investing with PennantPark will expose the investor to various risks including, but not limed to, the following: 1) Lack of Liquidity Risks including lack of permitted withdrawals, lack of secondary market, and lack of transferability 2) Interest Rate Volatility Risks 3) Use of Leverage Risks 4) Securitization Risks 5) Credit Market Disruption Risks 6) Investing within a Highly Competitive Market Risks 7) Default by Borrowers Risks 8) Recovery on Bad Debt Risks including cost of recovery 9) International Market Exposure Risks 10) Inflation and Deflation Exposure Risks. This is not intended to be a complete description of the risks of investing with PennantPark. Investors should rely on their own examination of the potential risks and rewards. The firm brochure (Form ADV 2A) is available online at www.adviserinfo.sec.gov or upon request and discusses these and other important risk factors and considerations that should be carefully evaluated before making an investment.

This document is directed at and intended for sophisticated investors. The information contained here does not constitute, and is not intended to constitute, an offer of securities and accordingly should not be construed as such. Information in this document does not constitute legal, tax, or investment advice. Before acting on any information in this document, current and prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions or obtain independent tax, legal, or investment advice.

Statements in this document are made as of the date hereof unless stated otherwise herein, and neither the delivery of this Document at any time, nor any sale hereunder, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. PennantPark believes that such information is accurate and that the sources from which it has been obtained are reliable. PennantPark cannot guarantee the accuracy of such information, however, and has not independently verified the assumptions on which such information is based. Certain statements contained in this Document, including without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects,” and words of similar import constitute “forward looking statements.” Additionally, any forecasts and estimates provided herein are forward-looking statements. Such statements and other forward-looking statements are based on available information and the views of PennantPark as of the date hereof. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results and events may differ materially from those in any forward-looking statements. Further, any opinions expressed are the current opinions of PennantPark only and may be subject to change, without notice. There is no undertaking to update any of the information in this document. No person has been authorized in connection with this document to give any information or to make any representations other than as contained in this document and, if given or made, such information or representation must not be relied upon as having been authorized by PennantPark Investment Advisers, LLC (“PennantPark”) or PennantPark’s affiliates.