Private credit, specifically direct lending, is gaining popularity in investor portfolios. With all of this talk about private credit strategies, how about a little refresher?

Private credit refers to debt privately originated by an asset manager without the intermediation of a bank or traded on any public market. This direct approach can achieve greater efficiency, confidentiality, and certainty of closing for the borrower than borrowing from a bank. The lender typically benefits by securing tight financial protections and higher yields. Unlike public debt, rating agencies do not rate private credit loans.

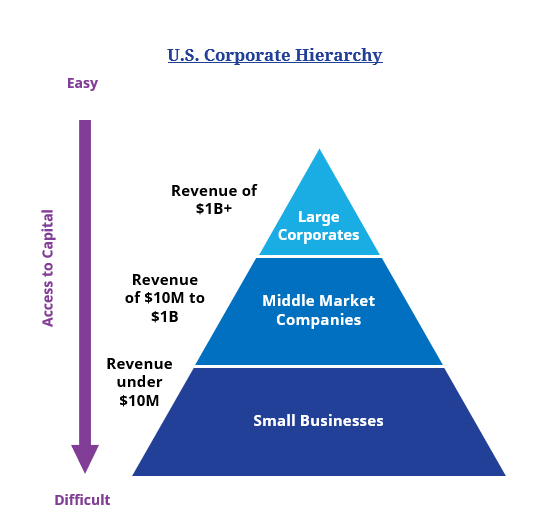

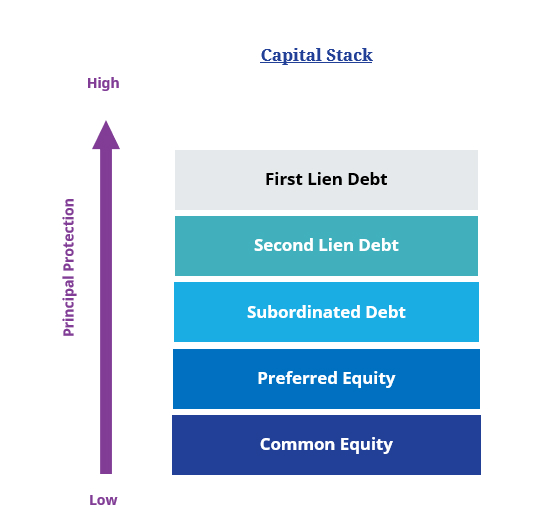

There are various types of private credit strategies across various segments of the market. Across market segments, private credit can span the capital stack of small businesses, up to very large corporations.

For illustrative purposes only.

At PennantPark, within our Senior Debt Strategy, we focus on Direct Lending. These debt instruments are directly originated first-lien loans in the core middle market. Our Senior Debt Strategy targets profitable, growing, cash-flowing companies with $10-$50M in earnings across five primary sectors: healthcare, government services, software & technology, consumer, and business services. Our direct lending deals are structured with floating-rate yields, over a specified reference rate (usually LIBOR or SOFR), at the top of the capital structure, with a minimum of two financial covenants.

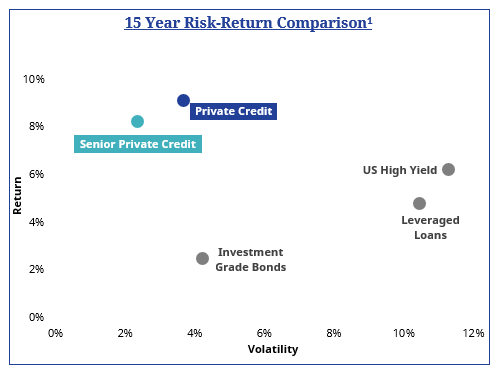

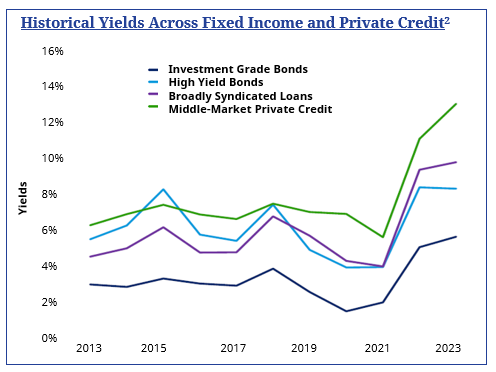

If structured properly, direct lending strategies have the potential to generate returns similar to, or higher than, other credit investments, with less risk and less volatility. Below, we outline the three primary reasons that investors are increasing their allocations to direct lending.

Investors are increasingly allocating to private credit, and direct lending is gaining particular attention. According to a survey by Mercer Investments and CAIS, 98% of the 260 participating financial advisors were already investing in private credit, and 68% planned to increase their allocations over the next 12 months1. What are the expected benefits?

1 Why Private Credit Is the Alternative Asset Class Everyone Covets | February 2024

Note: Past performance is not necessarily indicative of future results. Invested capital is at risk. Volatility is measured using standard deviation.

©2024 PennantPark Investment Advisers, LLC (‘PennantPark’) is an investment adviser registered with the US Securities and Exchange Commission (‘SEC’). Registration is not an endorsement by the SEC nor an indication of any specific level of skill. Products or services referenced in this document may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document, or the merits of the products and services referenced herein. This document and the information contained herein has been made available in accordance with the restrictions and/or limitations implemented by applicable laws and regulations.

In considering the past performance information contained herein, recipients should bear in mind that past performance is not a guarantee, projection or prediction and it is not a guarantee or indication of future results. Invested capital is at risk. There can be no assurance that any product or service referenced herein will achieve comparable results, or that they will be able to implement their investment strategies or achieve their investment objectives.

An investment with PennantPark in any advised fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period. There can be no assurance that any investment will be profitable, not lose money, or achieve the other intended purposes for which they are made. Investing with PennantPark will expose the investor to various risks including, but not limed to, the following: 1) Lack of Liquidity Risks including lack of permitted withdrawals, lack of secondary market, and lack of transferability 2) Interest Rate Volatility Risks 3) Use of Leverage Risks 4) Securitization Risks 5) Credit Market Disruption Risks 6) Investing within a Highly Competitive Market Risks 7) Default by Borrowers Risks 8) Recovery on Bad Debt Risks including cost of recovery 9) International Market Exposure Risks 10) Inflation and Deflation Exposure Risks. This is not intended to be a complete description of the risks of investing with PennantPark. Investors should rely on their own examination of the potential risks and rewards. The firm brochure (Form ADV 2A) is available online at www.adviserinfo.sec.gov or upon request and discusses these and other important risk factors and considerations that should be carefully evaluated before making an investment.

This document is directed at and intended for sophisticated investors. The information contained here does not constitute, and is not intended to constitute, an offer of securities and accordingly should not be construed as such. Information in this document does not constitute legal, tax, or investment advice. Before acting on any information in this document, current and prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions or obtain independent tax, legal, or investment advice.

Statements in this document are made as of the date hereof unless stated otherwise herein, and neither the delivery of this Document at any time, nor any sale hereunder, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. PennantPark believes that such information is accurate and that the sources from which it has been obtained are reliable. PennantPark cannot guarantee the accuracy of such information, however, and has not independently verified the assumptions on which such information is based. Certain statements contained in this Document, including without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects,” and words of similar import constitute “forward looking statements.” Additionally, any forecasts and estimates provided herein are forward-looking statements. Such statements and other forward-looking statements are based on available information and the views of PennantPark as of the date hereof. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results and events may differ materially from those in any forward-looking statements. Further, any opinions expressed are the current opinions of PennantPark only and may be subject to change, without notice. There is no undertaking to update any of the information in this document. No person has been authorized in connection with this document to give any information or to make any representations other than as contained in this document and, if given or made, such information or representation must not be relied upon as having been authorized by PennantPark Investment Advisers, LLC (“PennantPark”) or PennantPark’s affiliates.