Nineties hip-hop artist, Notorious B.I.G., may as well have written “Mo Money, Mo Problems” about credit mega-fund capital deployment

Private credit as an asset class has grown to $1.4 trillion in assets under management since the Global Financial Crisis1. This rapid growth of private credit has resulted in the appearance of mega-fund managers. According to Briarcliffe Credit Partners, “the top 10 private debt managers today account for nearly one-third of the AUM for the entire asset class1.”

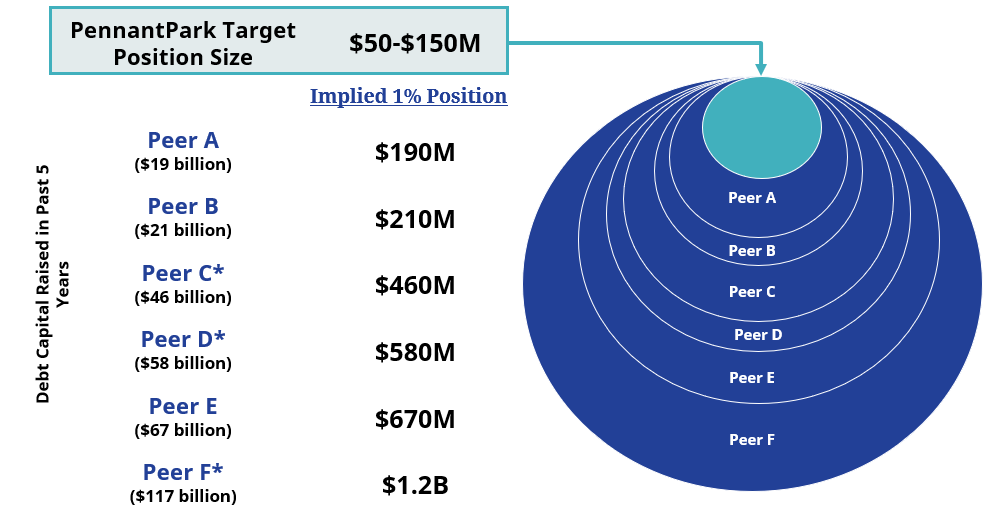

The top five largest private credit firms raised more than $340 billion from 2017-2022, compared to a total of $322 billion in capital raised by the 30 largest private credit managers from 2008-20131. This rapid growth in fundraising dollars has forced the mega-fund managers to abandon the core-middle market and move upstream to be able to efficiently put their capital to work.

1Source: Private Debt Investor: The Decade as of June 2023

Source: Private Debt Investor PDI 100 rankings December 2023. Peers include Golub Capital, Crescent Capital, Oaktree Capital Management, Blackstone, HPS Investment Partners, and Ares Management. Capital amounts are based on the amount of private debt investment capital raised by firms over the past five years. Area of circles is roughly proportional to the size of the implied 1% position.

* Signifies publicly traded asset management company.

Put simply, investing $50 to $150 million in a deal is not an efficient approach when deploying tens of billions of dollars. Mega-fund managers must target much larger investments to deploy their capital raised. At PennantPark, we invest in the core-middle market, defined as companies with earnings of $10 to $50 million. We are disciplined fundraisers, targeting fund sizes that are appropriate for our segment of the market.

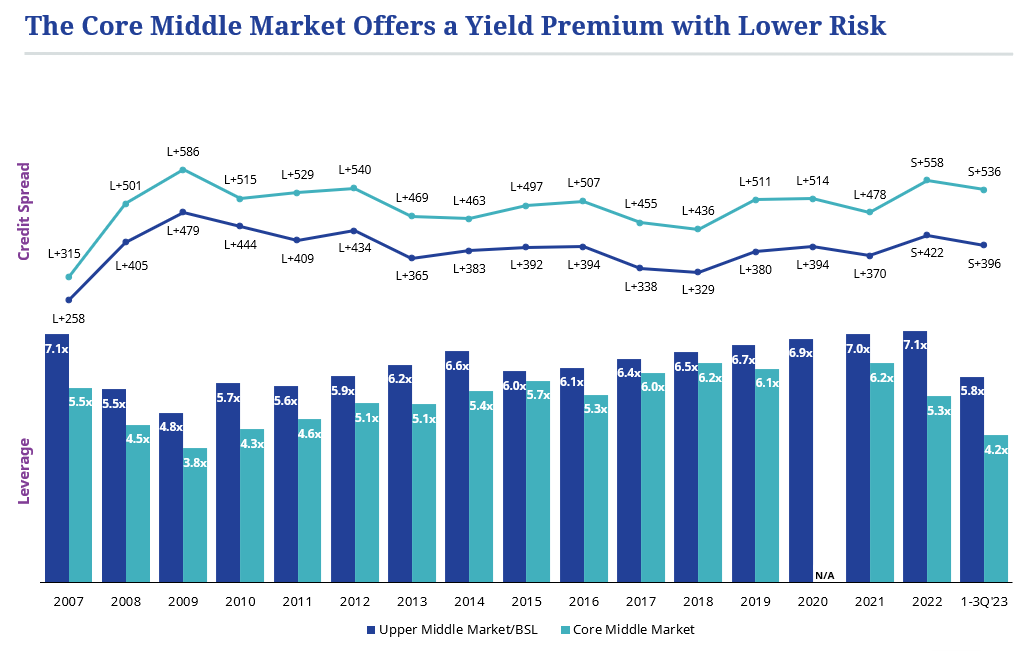

Why are we so committed to the core-middle market? As shown in the graph below, investments in the core-middle market have historically benefitted from higher yield premiums, lower average leverage multiples, and stronger covenant packages compared to upper-middle market and broadly syndicated loans. This can translate to increased returns with stronger downside mitigations for our investors.

Source: Refinitiv as of September 2023. Core Middle Market is defined as Issuers with revenues of $500M and below, and total loan package of less or equal to $500M. Upper Middle Market and BSL are defined as syndicated or direct/clubbed deals that have either revenues or total loan package of $500M or greater. Broadly Syndicated Loans are denoted as “BSL”. For 2020 Refinitiv does not have sufficient observations at this time to provide data for MM.

The mega-fund managers are often competing with each other, as well as banks and the broadly syndicated loan market, for some of the largest deals in the market. This increase in competition has put downward pressure on the premiums earned and has eroded many of the structural protections that are afforded in the core-middle market, where there is less competition among managers.

Many of the mega-fund managers are publicly traded and are pressured to achieve aggressive AUM growth to support their stock price. At PennantPark, we remain a private, independent, asset manager, with our fiduciary responsibility solely to our investors.

We welcome a conversation; please contact invest@pennantpark.com or the professionals listed below.

The information contained in this Presentation does not constitute and is not intended to constitute an offer of securities and accordingly should not be construed as such. Any products or services referenced in this Presentation may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document or the merits of the products and services referenced herein. This Presentation and the information contained herein has been made available in accordance with the restrictions and/or limitations implemented by any applicable laws and regulations. This Presentation is directed at and intended for institutional investors.

Furthermore, this Presentation is provided on a confidential basis for informational purposes only and may not be reproduced in any form. Before acting on any information in this Presentation, current and prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions and obtain independent advice if required. This Presentation has been made available only for each qualified recipient’s use, and should not be given, forwarded or shown to any other person (other than the recipient’s employees, agents, or consultants).

No person has been authorized in connection with this offering to give any information or to make any representations other than as contained in this Presentation and, if given or made, such information or representation must not be relied upon as having been authorized by PennantPark Investment Advisers, LLC (“PennantPark”) or PennantPark’s affiliates. Statements in this Presentation are made as of the date hereof unless stated otherwise herein, and neither the delivery of this Presentation at any time, nor any sale hereunder, shall under any circumstances create an implication that the information contained herein is correct as of any time subsequent to such date.

An investment in the interests of any PennantPark fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period of time. There can be no assurance that any investments will be profitable, not lose money, or achieve the other intended purposes for which they are made. In particular, the risks of investing in such funds may include: 1) Lack of liquidity in that withdrawals are generally not permitted, and there is no secondary market for Interests and none is expected to develop; 2) Restrictions on transferring Interests; 3) The use of leverage; and 4) Less regulation and higher fees than mutual funds. This is not intended to be a complete description of the risks of investing in such funds. Investors should rely on their own examination of the potential risks and rewards. The Offering Memorandum will discuss these and other important risk factors and considerations that should be carefully evaluated before making an investment. Prospective investors should consult with their own legal, tax, and financial advisers as to the consequences of an investment.

Certain statements contained in this Presentation, including without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects,” and words of similar import constitute “forward looking statements.” Additionally, any forecasts and estimates provided herein are forward looking statements. Such statements and other forward looking statements are based on available information and the views of PennantPark as of the date hereof. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results and events may differ materially from those in any forward looking statements. Further, any opinions expressed are the current opinions of PennantPark only and may be subject to change, without notice. There is no undertaking to update any of the information in this document.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third party sources. PennantPark believes that such information is accurate and that the sources from which it has been obtained are reliable. PennantPark cannot guarantee the accuracy of such information, however, and has not independently verified the assumptions on which such information is based.