Perception Versus Reality: Despite the claim that bigger companies are safer investments than smaller ones, the data tells us otherwise.

There is a widely-held misconception that bigger companies are safer investments than smaller ones. Mega Fund managers are happy to perpetuate this claim to further their fundraising agendas. These managers claim big companies have more established operations, larger market shares, and better access to capital markets. They’re simply too big to fail! Where have we heard that before?

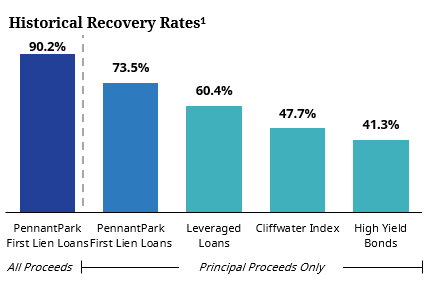

Despite this claim, the data tells us otherwise. While big companies may benefit from economies of scale, they do not necessarily make for safer credit investments. In reality, large corporations tend to have much riskier, highly leveraged capital structures that can put them at increased risk of payment default, especially in today’s high-interest rate environment. As shown below, the core-middle market (PennantPark First Lien Loans) has a higher recovery rate compared to the other market segments. Additionally, these companies tend to not have the protective covenants of medium-sized companies.

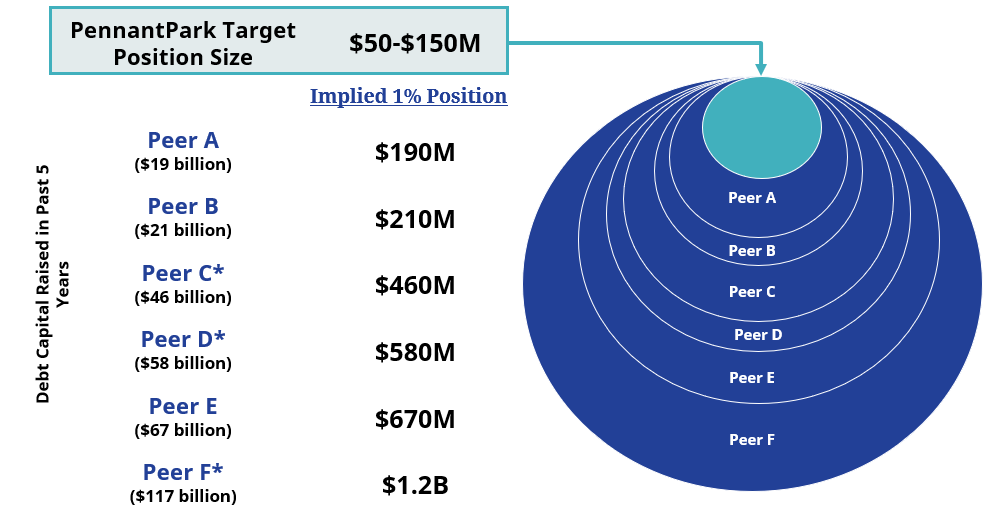

Why do Mega Fund managers tout this false narrative? Many are forced to move up-market to invest in the big companies with larger capital structures due to their need to deploy billions of assets. Smaller investments in core middle market companies simply do not “move the needle” for these managers.

Source: Private Debt Investor PDI 100 rankings December 2023. Peers include Golub Capital, Crescent Capital, Oaktree Capital Management, Blackstone, HPS Investment Partners, and Ares Management. Capital amounts are based on the amount of private debt investment capital raised by firms over the past five years. Area of circles is roughly proportional to the size of the implied 1% position.

* Signifies publicly traded asset management company.

As a result, these managers are often targeting investments in direct competition with the broadly syndicated loan market from banks. This competition compresses the illiquidity premium paid and results in covenant-lite structures.

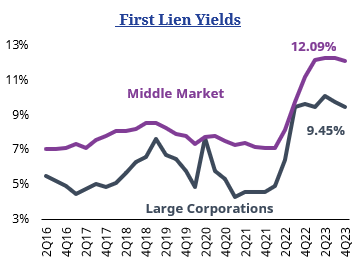

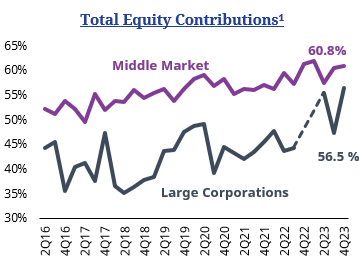

With this in mind, at PennantPark, we invest in the core-middle market, where there is less competition and target loans with persistently lower leverage multiples, more conservative loan-to-value ratios, and higher interest coverage ratios. Middle-market companies are generally considered underbanked and historically have less access to typical financing. This deficiency of bank capital can give middle market managers, such as PennantPark, the potential to secure favorable terms with tighter financial covenants and additional protections, even as the broadly syndicated loan market has migrated almost entirely to covenant-lite loans.

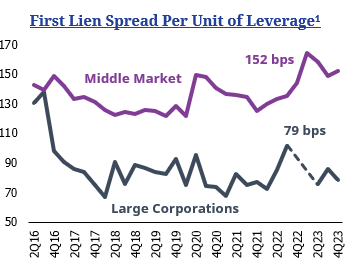

Below, Refinitiv provides some excellent data showing how middle market first lien loans have historically generated higher yields, compared to large corporations, and with lower risk in today’s environment.

PennantPark remains disciplined in our approach to lending to core-middle market companies that benefit from underlying solid growth fundamentals. We focus on first-lien loans to cashflowing companies, where we aim to leverage our flexible financing to secure lower leverage and higher yields in combination with strong covenant packages. We have been investing in the middle market for 17 years through various economic cycles and remain committed to our approach.

Ultimately, we urge investors to do their homework and refrain from following industry tropes that don’t hold up under scrutiny. Thorough due diligence should always include an in-depth analysis of a manager’s default, recovery, and loss history – with skepticism toward those managers who have never invested through a full economic cycle.

We welcome a conversation; please contact invest@pennantpark.com or the professionals listed below.

The information contained in this Presentation does not constitute and is not intended to constitute an offer of securities and accordingly should not be construed as such. Any products or services referenced in this Presentation may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document or the merits of the products and services referenced herein. This Presentation and the information contained herein has been made available in accordance with the restrictions and/or limitations implemented by any applicable laws and regulations. This Presentation is directed at and intended for institutional investors.

Furthermore, this Presentation is provided on a confidential basis for informational purposes only and may not be reproduced in any form. Before acting on any information in this Presentation, current and prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions and obtain independent advice if required. This Presentation has been made available only for each qualified recipient’s use, and should not be given, forwarded or shown to any other person (other than the recipient’s employees, agents, or consultants).

No person has been authorized in connection with this offering to give any information or to make any representations other than as contained in this Presentation and, if given or made, such information or representation must not be relied upon as having been authorized by PennantPark Investment Advisers, LLC (“PennantPark”) or PennantPark’s affiliates. Statements in this Presentation are made as of the date hereof unless stated otherwise herein, and neither the delivery of this Presentation at any time, nor any sale hereunder, shall under any circumstances create an implication that the information contained herein is correct as of any time subsequent to such date.

An investment in the interests of any PennantPark fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period of time. There can be no assurance that any investments will be profitable, not lose money, or achieve the other intended purposes for which they are made. In particular, the risks of investing in such funds may include: 1) Lack of liquidity in that withdrawals are generally not permitted, and there is no secondary market for Interests and none is expected to develop; 2) Restrictions on transferring Interests; 3) The use of leverage; and 4) Less regulation and higher fees than mutual funds. This is not intended to be a complete description of the risks of investing in such funds. Investors should rely on their own examination of the potential risks and rewards. The Offering Memorandum will discuss these and other important risk factors and considerations that should be carefully evaluated before making an investment. Prospective investors should consult with their own legal, tax, and financial advisers as to the consequences of an investment.

Certain statements contained in this Presentation, including without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects,” and words of similar import constitute “forward looking statements.” Additionally, any forecasts and estimates provided herein are forward looking statements. Such statements and other forward looking statements are based on available information and the views of PennantPark as of the date hereof. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results and events may differ materially from those in any forward looking statements. Further, any opinions expressed are the current opinions of PennantPark only and may be subject to change, without notice. There is no undertaking to update any of the information in this document.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third party sources. PennantPark believes that such information is accurate and that the sources from which it has been obtained are reliable. PennantPark cannot guarantee the accuracy of such information, however, and has not independently verified the assumptions on which such information is based.