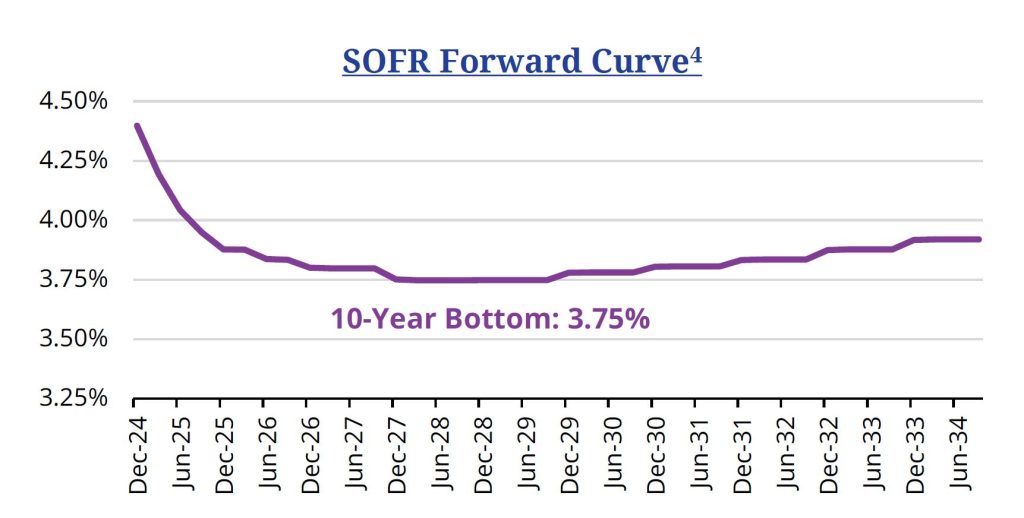

Private credit loans are generally structured as floating rate, often tied to a base rate like SOFR1, which is influenced by the Federal Funds Rate, plus a credit spread. These elements, along with the original issue discount, are the core components of a loan’s overall yield.

In 2024, the Federal Reserve lowered interest rates twice, reducing the Federal Funds Rate from 4.75- 5% in September to 4.50-4.75% in November2. This marks the lowest Fed Funds rate since early 2023.

At the same time, competition in the private credit market is heating up as continued demand for private lending over traditional bank lending fuels sector growth. This heightened competition has led to tighter spreads, which in turn also compresses yields.

Individually, lower base rates and spread compression would not ring an alarm. But taken together, investors can’t help but wonder what they mean for the future of private credit.

This article examines how these dynamics could impact return expectations and highlights how PennantPark’s strategy of lending to private equity sponsored companies in the core middle market ($10M-$50M in earnings) can help investors navigate this evolving landscape.

Understanding The Implications of Spread Compression and Rate Cuts

Spreads typically tighten with improving economic conditions and widen when default risk increases, often during economic downturns. In private credit, however, the intensified competition for deals has driven spreads even tighter. While this benefits borrowers with lower cost of debt, it squeezes margins for lenders and investors.

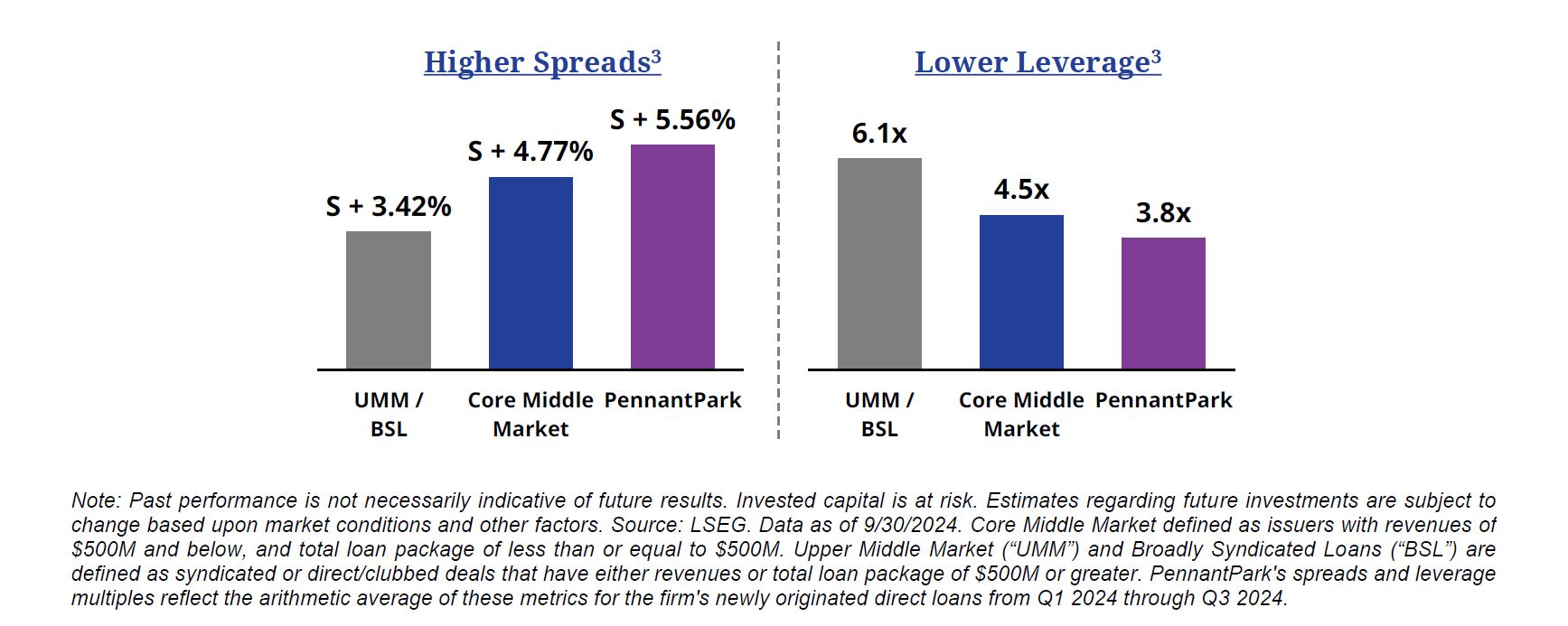

This effect is particularly acute in the upper middle market (companies with earnings north of $50M), where competition comes not only from mega funds with substantial capital reserves, but also from the re-entry of traditional banks into the lending space. In contrast, the core middle market faces less spread compression due to its relationship-driven nature and reduced competitive pressure.

Despite recent rate cuts, base rates are expected to remain higher than the historically low levels seen over the past 15 years. The current SOFR1 curve expects base rates to bottom out at 3.75%2 over the next decade. This creates a strong foundation for high yields, despite the ongoing spread compression.

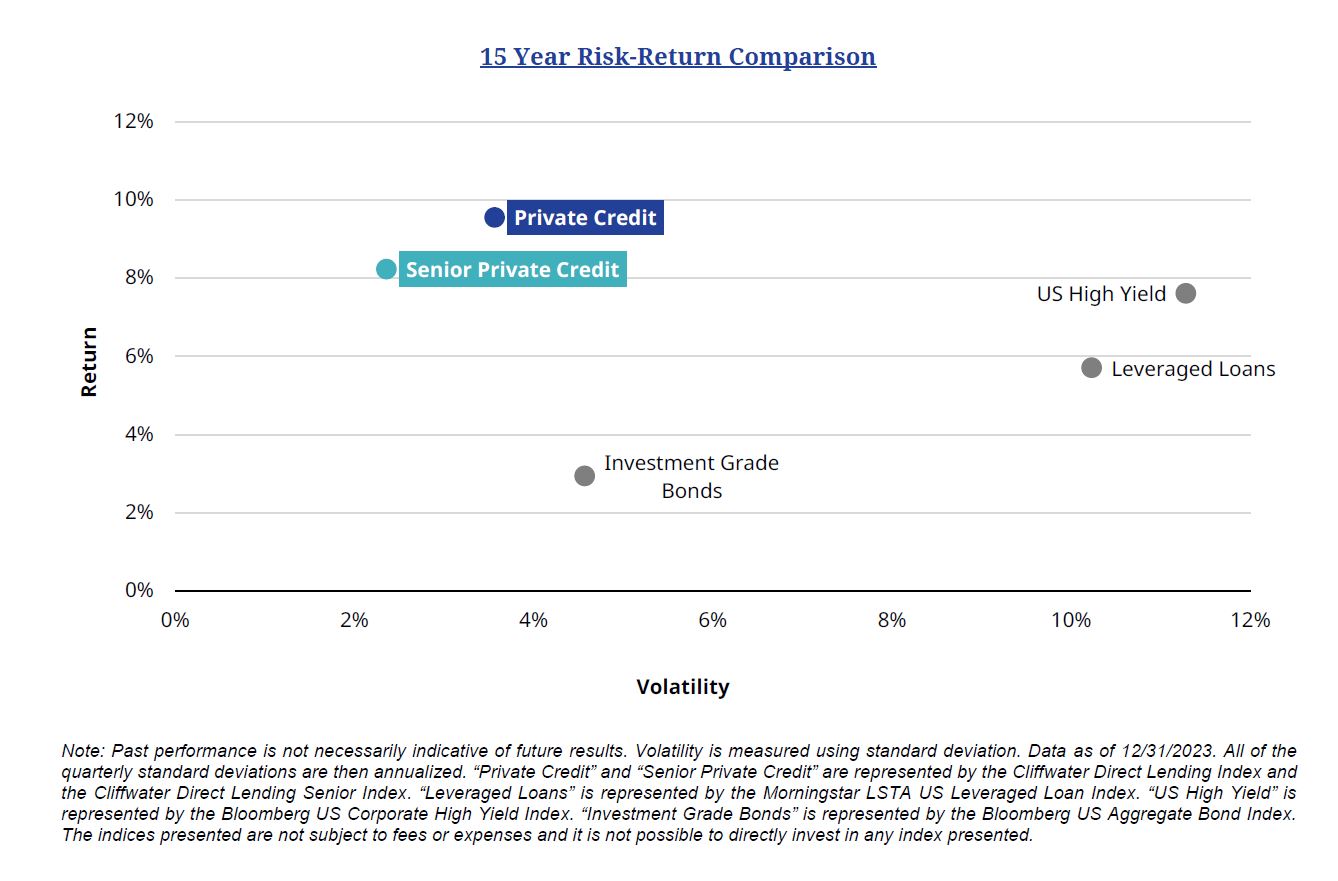

Although these dynamics pose challenges, private credit has weathered low interest rate environments before, consistently delivering higher yields and lower volatility than traditional fixed-income investments. For investors seeking to generate income alpha while preserving capital, selecting the right managers and strategies will be crucial.

Our Approach to Private Credit Investing

At PennantPark, we believe private credit is a resilient asset class, capable of delivering strong outcomes even in challenging markets. Our success is driven by three core pillars: a dedicated focus on the core middle market, an extensive sourcing network, and the expertise of our experienced management team with over 27 years of industry experience. We have successfully invested through the most severe market cycles, including the global financial crisis (GFC) and COVID-19 pandemic, demonstrating our ability to navigate complexity and deliver results.

We focus exclusively on the core middle market, targeting companies with $10–$50 million in earnings. This underserved segment allows us to identify compelling opportunities, negotiate favorable loan terms, and deliver value-added capital. By avoiding the crowded upper middle market competition, we maintain a strategic advantage in structuring and pricing deals.

Our extensive sourcing network, cultivated over decades, includes relationships with more than 770 private equity sponsors across the U.S. These strong relationships provide access to a steady pipeline of high-quality opportunities. Combined with our rigorous due diligence process, this network ensures we can identify and capitalize on resilient investments poised to weather economic cycles.

At the heart of our strategy is PennantPark’s experienced management team. With over 27 years of expertise and a proven track record of navigating market cycles, we leverage deep industry knowledge to identify opportunities, manage risk, and drive value.

Through this thoughtful approach, we continue to support the growth of middle market businesses while preserving capital and maximizing returns for our investors.

PennantPark is an independent middle market credit platform founded in 2007 by private credit industry veteran Art Penn (Co-Founder and former Managing Partner at Apollo Credit). As of 2025, PennantPark has invested over $23 billion in over 765 private credit transactions since its inception. Our clients include some of the world’s largest and most sophisticated institutional investors. We are in the process of expanding our offerings to focus on the private wealth market. The Firm is headquartered in Miami and has additional offices in New York, Chicago, Houston, Los Angeles, and Amsterdam. PennantPark primarily invests in the core middle market, defined as companies with earnings of $10 million to $50 million. Our industries of focus include business services, government services, healthcare, consumer, and software/technology. PennantPark offers investment strategies through various public and private fund structures, including BDCs, LP drawdown vehicles, CLOs, SMAs, and joint ventures.

©2025 PennantPark Investment Advisers, LLC (‘PennantPark’) is an investment adviser registered with the US Securities and Exchange Commission (‘SEC’). Registration is not an endorsement by the SEC nor an indication of any specific level of skill. Products or services referenced in this document may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document, or the merits of the products and services referenced herein. This document and the information contained herein has been made available in accordance with the restrictions and/or limitations implemented by applicable laws and regulations.

In considering the past performance information contained herein, recipients should bear in mind that past performance is not a guarantee, projection or prediction and it is not a guarantee or indication of future results. Invested capital is at risk. There can be no assurance that any product or service referenced herein will achieve comparable results, or that they will be able to implement their investment strategies or achieve their investment objectives.

An investment with PennantPark in any advised fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period. There can be no assurance that any investment will be profitable, not lose money, or achieve the other intended purposes for which they are made. Investing with PennantPark will expose the investor to various risks including, but not limited to, the following: 1) Lack of Liquidity Risks including lack of permitted withdrawals, lack of secondary market, and lack of transferability 2) Interest Rate Volatility Risks 3) Use of Leverage Risks 4) Securitization Risks 5) Credit Market Disruption Risks 6) Investing within a Highly Competitive Market Risks 7) Default by Borrowers Risks 8) Recovery on Bad Debt Risks including cost of recovery 9) International Market Exposure Risks 10) Inflation and Deflation Exposure Risks. This is not intended to be a complete description of the risks of investing with PennantPark. Investors should rely on their own examination of the potential risks and rewards. The firm brochure (Form ADV 2A) is available online at www.adviserinfo.sec.gov or upon request and discusses these and other important risk factors and considerations that should be carefully evaluated before making an investment.

This document is directed at and intended for sophisticated investors. The information contained here does not constitute, and is not intended to constitute, an offer of securities and accordingly should not be construed as such. Information in this document does not constitute legal, tax, or investment advice. Before acting on any information in this document, current and prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions or obtain independent tax, legal, or investment advice.

Statements in this document are made as of the date hereof unless stated otherwise herein, and neither the delivery of this Document at any time, nor any sale hereunder, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. PennantPark believes that such information is accurate and that the sources from which it has been obtained are reliable. PennantPark cannot guarantee the accuracy of such information, however, and has not independently verified the assumptions on which such information is based. Certain statements contained in this document, including without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects,” and words of similar import constitute “forward-looking statements.”Additionally, any forecasts and estimates provided herein are forward-looking statements. Such statements and other forward-looking statements are based on available information and the views of PennantPark as of the date hereof. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results and events may differ materially from those in any forward-looking statements. Further, any opinions expressed are the current opinions of PennantPark only and may be subject to change, without notice. There is no undertaking to update any of the information in this document. No person has been authorized in connection with this document to give any information or to make any representations other than as contained in this document and, if given or made, such information or representation must not be relied upon as having been authorized by PennantPark Investment Advisers, LLC (“PennantPark”) or PennantPark’s affiliates.