PIK is a financing mechanism that allows borrowers to pay interest with additional debt rather than cash. While this tool can temporarily relieve liquidity pressure, it does so by increasing future repayment obligations and repayment risk.

Historically, PIK was primarily associated with distressed credit. Today, however, given elevated corporate leverage and the higher cost of debt in an elevated interest rate environment, many private credit managers are increasingly introducing PIK even into senior loan structures.

As a measure of risk, PIK levels are also a meaningful measurement for investors to review. While it’s important to monitor non-accruals in a portfolio, reviewing PIK interest provides a more well-rounded view of overall risk. And since non-accrual definitions can vary across sponsors and managers, PIK levels are uniformly defined and required to be reported.

PIK is sometimes used to help companies preserve liquidity and avoid technical defaults. While this may provide short-term relief, it does not resolve the underlying issue. PIK accruals increase leverage, leaving companies more vulnerable to future repayment challenges.

This dynamic can make reported yields appear strong because managers recognize PIK as income. However, no real cash is generated and debt simply grows larger. For investors focused on capital preservation, the key is distinguishing between limited, manageable use of PIK and systemic reliance that masks deeper weakness.

PIK can take different forms depending on the credit health of the borrower and the lender’s objectives.

At the onset of a loan, lenders may allow a borrower to choose between paying interest in cash or in-kind. This “toggle” structure gives flexibility during periods of heavy investment, growth, or volatility.

When a company’s credit profile deteriorates, lenders may require interest to be paid in-kind because cash interest is no longer feasible. This mandatory PIK structure is often a red flag of weakening fundamentals.

More recently, some managers have adopted “synthetic PIK,” where a small revolver or delayed-draw facility is provided alongside the main loan. Borrowers draw on this facility to pay interest, creating the appearance of cash payments while effectively adding new debt. Because it obscures stress and inflates leverage, synthetic PIK warrants the same caution as traditional PIK.

The impact of PIK depends less on its presence and more on its scale. A modest allocation can be consistent with healthy credit fundamentals, particularly when tied to temporary borrower needs. In those cases, PIK provides short-term flexibility without materially changing the overall risk profile.

Concerns arise when PIK grows beyond the low single digits of portfolio income. Once it reaches 10%-15% or higher, it signals that borrowers are relying on debt rather than operating cash flow to service obligations. Reported yields may remain steady, but they are supported by non-cash accruals that compound leverage and increase repayment risk.

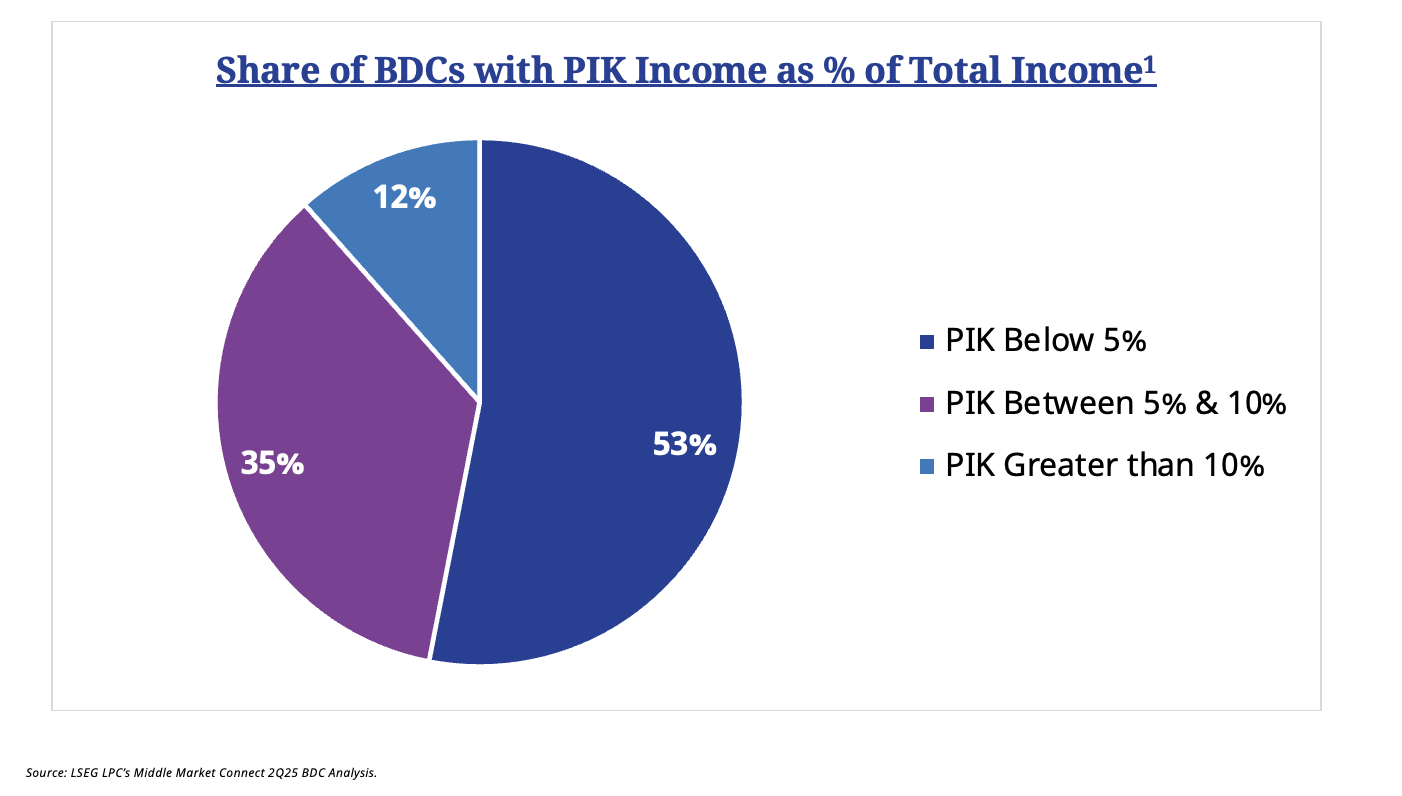

As of Q2’25, nearly half (47%) of Business Development Companies (BDCs) reported PIK income as a percentage of total interest income above 5% and 12% of BDCs reported PIK levels above 10%1. These figures highlight how widespread non-cash income has become and why vigilance around PIK levels is essential for capital preservation.

While PIK exists across all segments of the private credit market, its usage and implications can vary meaningfully. In the upper middle market, where deal sizes are larger and competition among lenders is more intense, underwriting discipline has often given way to “chasing deals.” By contrast, the core and lower middle market tend to reflect stronger underwriting standards and closer lender-borrower relationships. Sponsors and lenders in this segment often negotiate more robust covenants and maintain a greater focus on real cash flow generation. These dynamics make it easier to detect early warning signs and limit over-reliance on .

At PennantPark, our investment philosophy is clear: safety comes first. We focus on lending to leading companies in defensive industries such as Government Services, Business Services, and Healthcare. These are businesses with durable models and strong free cash flow generation. By emphasizing resilient borrowers, we minimize the need for non-cash income and reduce exposure to systemic reliance on PIK. In line with our conservative approach, our exposure to PIK loans remain below 3% across our senior debt strategy (PFLT), significantly lower than average (as of 6/30/2025).

At PennantPark, we prioritize stable and cash-flowing borrowers and maintain limited exposure to PIK loans. In fact, PennantPark Floating Rate Capital Ltd. (NYSE: PFLT) had virtually no exposure to PIK loans as of 6/30/2025, according to a recent Raymond James research report. In contrast, some lenders now generate more than 25% of their investment income from full or partial PIK loans.

Just as private credit managers must be selective in the loans they originate, investors must be equally selective in choosing their private credit partners. Too often, headline yields are supported by rising levels of PIK rather than true cash generation. This is particularly important today: nearly 95% of private credit managers came to market after the Global Financial Crisis*, an era defined by low interest rates and unusually low default levels. That backdrop no longer applies. We are now in a higher-rate, more volatile credit environment where experience, discipline, and a focus on capital preservation are essential.

Investors should look closely at whether managers are relying on PIK to support reported performance or whether they are building portfolios of companies that consistently generate the cash needed to service debt. Choosing a conservative, battle-tested manager with historically low PIK exposure is the best hedge against elevated PIK and the repayment risks it represents.

*PennantPark and Preqin’s database of first-time direct lending funds launched by an asset manager globally as of February 2025. The list includes funds launched from 1995-2024.

PennantPark is an independent middle market credit platform founded in 2007 by private credit industry veteran Art Penn (Co-Founder and former Managing Partner at Apollo Credit). As of 2025, PennantPark has invested over $26 billion in over 780 private credit transactions since its inception. Our clients include some of the world’s largest and most sophisticated institutional investors. We are in the process of expanding our offerings to focus on the private wealth market. The Firm is headquartered in Miami and has additional offices in New York, Chicago, Houston, Los Angeles, and Amsterdam. PennantPark primarily invests in the core middle market, defined as companies with earnings of $10 million to $50 million. Our industries of focus include business services, government services, healthcare, consumer, and software/technology. PennantPark offers investment strategies through various public and private fund structures, including BDCs, LP drawdown vehicles, CLOs, SMAs, and joint ventures.

©2025 PennantPark Investment Advisers, LLC (‘PennantPark’) is an investment adviser registered with the US Securities and Exchange Commission (‘SEC’). Registration is not an endorsement by the SEC nor an indication of any specific level of skill. Products or services referenced in this document may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document, or the merits of the products and services referenced herein. This document and the information contained herein has been made available in accordance with the restrictions and/or limitations implemented by applicable laws and regulations.

In considering the past performance information contained herein, recipients should bear in mind that past performance is not a guarantee, projection or prediction and it is not a guarantee or indication of future results. Invested capital is at risk. There can be no assurance that any product or service referenced herein will achieve comparable results, or that they will be able to implement their investment strategies or achieve their investment objectives.

The information herein reflects PennantPark’s investment approach at the time of publication but does not guarantee specific outcomes. Leverage levels, underwriting processes, and risk assessments are subject to change and may vary across investments. Leverage may magnify both gains and losses, and past strategies are not indicative of future performance or risk mitigation. Investing involves risk, including market fluctuations, liquidity constraints, regulatory considerations, and the potential loss of principal. Investors should carefully assess all associated risks before making investment decisions.

An investment with PennantPark in any advised fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period. There can be no assurance that any investment will be profitable, not lose money, or achieve the other intended purposes for which they are made. Investing with PennantPark will expose the investor to various risks including, but not limited to, the following: 1) Lackof Liquidity Risks including lack of permitted withdrawals, lack of secondary market, and lack of transferability 2) Interest Rate Volatility Risks 3) Use of Leverage Risks 4) Securitization Risks 5) Credit Market Disruption Risks 6) Investing within a Highly Competitive Market Risks 7) Default by Borrowers Risks 8) Recovery on Bad Debt Risks including cost of recovery 9) International Market Exposure Risks 10) Inflation and Deflation Exposure Risks. This is not intended to be a complete description of the risks of investing with PennantPark. Investors should rely on their own examination of the potential risks and rewards. The firm brochure (Form ADV 2A) is available online at www.adviserinfo.sec.gov or upon request and discusses these and other important risk factors and considerations that should be carefully evaluated before making an investment.

This document is directed at and intended for sophisticated investors. The information contained here does not constitute, and is not intended to constitute, an offer of securities and accordingly should not be construed as such. Information in this document does not constitute legal, tax, or investment advice. Before acting on any information in this document, current and prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions or obtain independent tax, legal, or investment advice.

Statements in this document are made as of the date hereof unless stated otherwise herein, and neither the delivery of this Document at any time, nor any sale hereunder, shall under any circumstances create an implication that the information contained herein is correct as of anytime after such date. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. PennantPark believes that such information is accurate and that the sources from which it has been obtained are reliable. PennantPark cannot guarantee the accuracy of such information, however, and has not independently verified the assumptions on which such information is based. Certain statements contained in this Document, including without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects,” and words of similar import constitute “forward looking statements.” Additionally, any forecasts and estimates provided herein are forward-looking statements. Such statements and other forward-looking statements are based on available information and the views of PennantPark as of the date hereof. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results and events may differ materially from those in any forward-looking statements. Further, any opinions expressed are the current opinions of PennantPark only and may be subject to change, without notice. There is no undertaking to update any of the information in this document. No person has been authorized in connection with this document to give any information or to make any representations other than as contained in this document and, if given or made, such information or representation must not be relied upon as having been authorized by PennantPark Investment Advisers, LLC (“PennantPark”) or PennantPark’s affiliates.