Key Themes:

Capital concentration with large asset managers is driving competitive pressure at the top end of the market

Before we dive into deal flow and pricing trends, it’s important to highlight the structural undercurrents shaping today’s market landscape. And we won’t beat around the bush; the private credit industry has gotten more competitive amid an influx of capital.

Private credit funds have raised nearly $1 trillion of capital since 2020. Direct lending alone has accounted for over $360 billion in fundraising over that span (Graph 1). The sheer magnitude of flows into the industry was bound to make an impact.

But that doesn’t mean that all segments of the market are experiencing the same competitive pressures. In fact, the data tells a clear story: capital is increasingly concentrated among the largest investment managers, and those managers are lending to relatively large companies. Private debt funds with over $1 billion of commitments accounted for a staggering 83% of fundraising in 2023. That trend has only accelerated to start 2024 (Graph 2).

As the largest managers jockey to deploy their newfound heaps of capital, they’ve ignited a race to the bottom in the upper middle market (i.e., companies with at least $50 million of earnings, and often much larger). The re-emergence of investment banks via broadly syndicated loans (“BSLs”) and a pick-up in collateralized loan obligation (“CLO”) formation have exacerbated the pressure (Graph 3).

Meanwhile, managers in the core middle market (i.e., companies with $10 million to $50 million of earnings) have enjoyed a more stable marketplace. These mid-sized borrowers are simply too small to move the needle for large investment firms that need to deploy tens of billions of dollars in short order.

For these reasons, we urge market participants to stop treating private credit like a monolith. As the asset class has matured, discrete market segments have emerged, each with unique structural dynamics. And as we detail below, the opportunity in the core middle market remains compelling even as competitive pressures overwhelm the financing market for large companies.

Refinancing activity has driven deal flow, though a buyout rebound may be on the horizon

The majority of lending activity during the first half of the year was driven by refinancing transactions (Graph 4). Borrowers were able to refinance at tighter credit spreads, providing some relief from higher-for-longer interest rates.

This refinancing risk was more pronounced in the upper middle market where even small spread adjustments can translate into meaningful dollar savings. While PennantPark did participate in a handful of refinancings, smaller borrowers may find it more difficult to justify the time and fees involved.

Encouragingly, the volume of loans backing mergers and acquisitions (“M&A”) increased to the highest levels since 2022. As of July, year-to-date M&A activity is already approaching the full-year total for 2023. We’re optimistic that this trend will accelerate into the second half as private equity sponsors are under increasing pressure to deploy their dry powder and exit their increasingly long-held investments (Graph 5). In addition, interest rate cuts could further boost M&A activity, especially if the Federal Reserve pulls off the elusive “soft landing.”

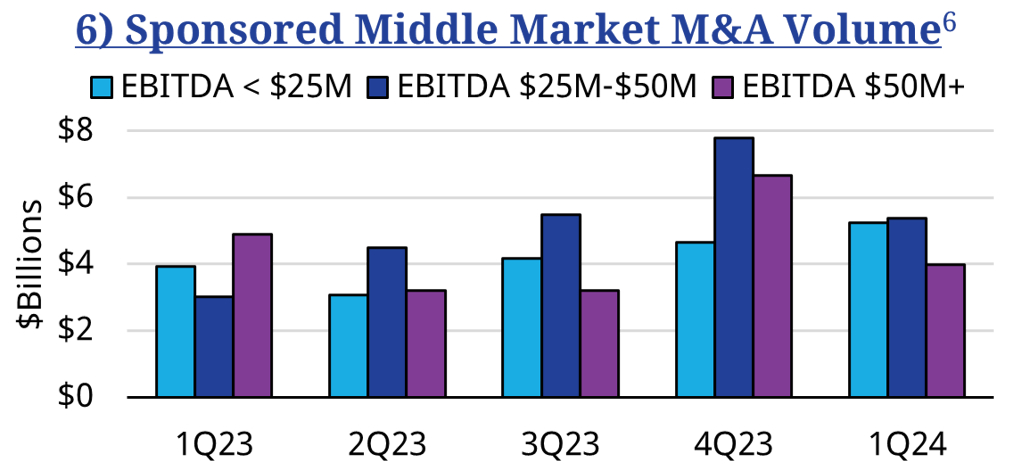

We have also observed that smaller companies have been more willing to transact in the face of higher rates and stalled valuations. Founders and family owners of core middle market companies are less likely to hold out for basis points when generational wealth is on the line, which may explain the pickup in deal flow in our market compared to buyout activity among larger companies (Graph 6).

Credit spreads have tightened, but risk-adjusted returns remain historically attractive

Pricing tightened to begin the year, with first lien credit spreads tightening to 5.25% in the core middle market. That compares to spreads in excess of 6.00% last year amid the fallout from the regional banking crisis. Competition for deals, an improving economic outlook, and clarity on interest rates have contributed to the spread tightening. We could see further tightening if this risk-on sentiment continues.

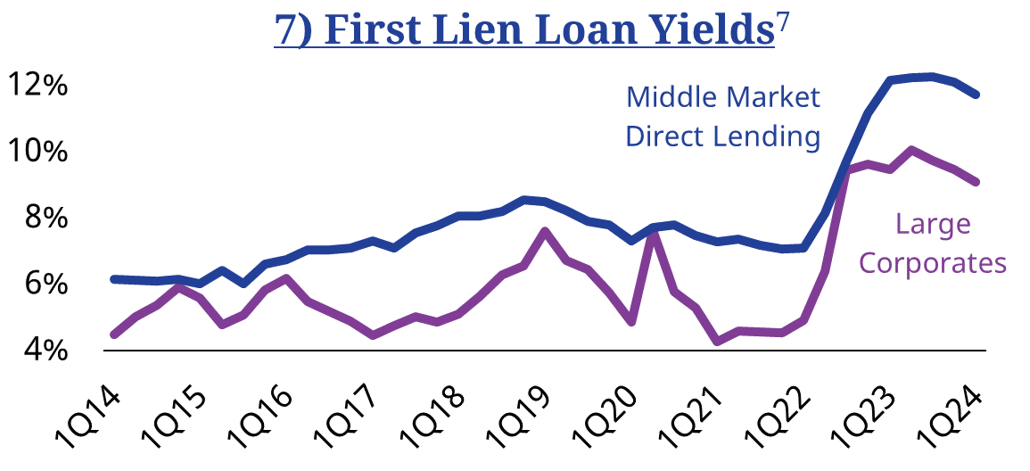

Despite pressure on spreads, risk-adjusted returns remain historically attractive. With the Secured Overnight Financing Rate (“SOFR”) hovering near 5.3%, all-in yields for core middle market first lien loans are approximately 11.7%. These levels significantly exceed the yields available over most of the past fifteen years during the prolonged near-zero interest rate environment (Graph 7).

Further, core middle market loans continue to pay a substantial premium over loans to large corporate borrowers. Yields on syndicated loans declined to about 9.1% during the first quarter. The 2.6% yield premium that we earn is evidence of the sharpening competition in the upper middle market, and our reward for pursuing resource-intensive direct originations.

Importantly, we never consider returns in a vacuum. The risk side of the equation is equally, if not more, important. Fortunately, risk-adjusted returns also remain historically attractive today. Our preferred measure of this relationship is the ratio of first lien loan spread per unit of leverage. This measure exceeded 1.50% of spread per turn of leverage during the first quarter, which remained elevated compared to most of the past decade (Graph 8). From a pure credit standpoint, we’re being paid well for the risk, before even considering lofty base rates.

We dutifully note the downturn in risk-adjusted returns in the upper middle market, where lenders earn spreads of only 0.64% per turn of leverage. Not only are credit spreads tighter in this market, but companies tend to pack on much more leverage. Needless to say, we believe these prices have become dislocated as large lenders and banks jostle to win deal flow.

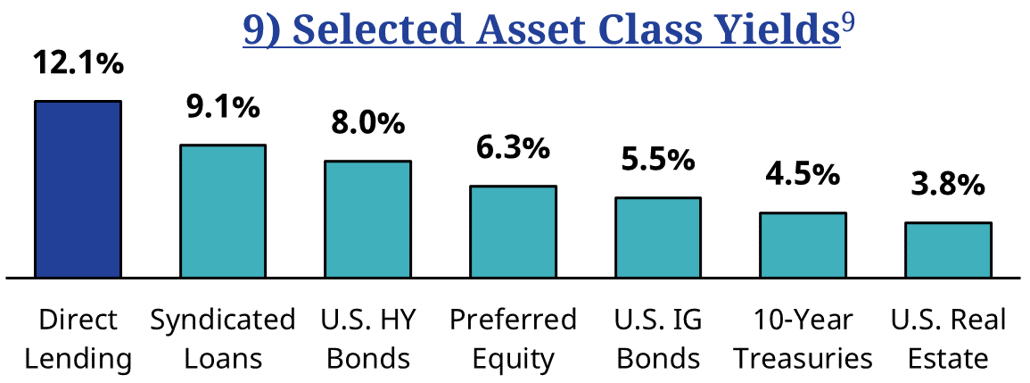

So far, we have mostly focused on the relative attractiveness of the core middle market compared to the top end of the lending market. In addition, we believe that direct lending yields stack up quite well compared to other asset classes (Graph 9).

Trading credit quality and lender protections for deal flow in the upper middle market

BSL and upper middle market lenders capitulated on more than just pricing as competition intensified. Recent data shows that loan-to-value ratios on loans to large corporate borrowers increased to 53% during the first quarter, compared to 38% in the middle market.10 As a result of more aggressive capital structures, those large companies contend with more burdensome interest payments that weigh on profits and cash flow.

In an effort to court borrowers, large direct lenders also embraced the “cov-lite” brand of loans that have long pervaded the BSL market (Graph 10). In simple terms, covenants are conditions written into the loan agreement intended to protect the lender from adverse actions and undue risk. In contrast, PennantPark continues to secure financial covenants on virtually all of our direct originations. Again, we observe diverging trends across multiple private credit segments.

According LSEG LPC, the share of cov-lite loans among new term loans in the upper middle market rose to the highest level since early 2022.12 While cov-lite loans remain the exception in the upper middle market, their growing popularity could spell trouble for certain managers if the economic cycle turns. As S&P Global said recently, “Historical data support the view that the absence of financial maintenance covenants weighs on ultimate recovery rates for defaulted first-lien term loans… first-lien term loans that were covenant-lite averaged a 61% discounted recovery from 2010 to September 2023, nearly 11 percentage points below the average recovery of covenanted first-lien term loans.”13

We can only hope that investors will finally reconsider the notion that large companies make for safer investments. Highly levered capital structures, sparse lender protections, and lower recovery rates suggest otherwise.

Default rates are low, but warning signs emerge

The U.S. economy continued to churn along at a healthy pace to begin the year. Our portfolio has performed quite well in this context, with average revenue and EBITDA up 10% and 8%, respectively, year-to-date through June compared to the same period last year.

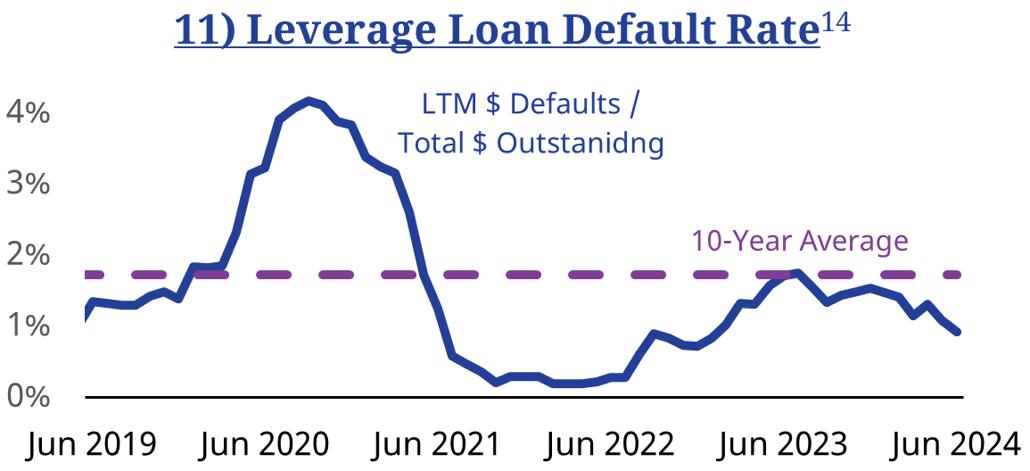

More broadly, corporate loan default rates have been low and falling. As of June 30, the Morningstar LSTA Leveraged Loan Index default rate was only 0.92% of total dollars outstanding. That reading is well below the ten-year average of 1.74% and down more than 60 basis points since the beginning of the year (Graph 11).

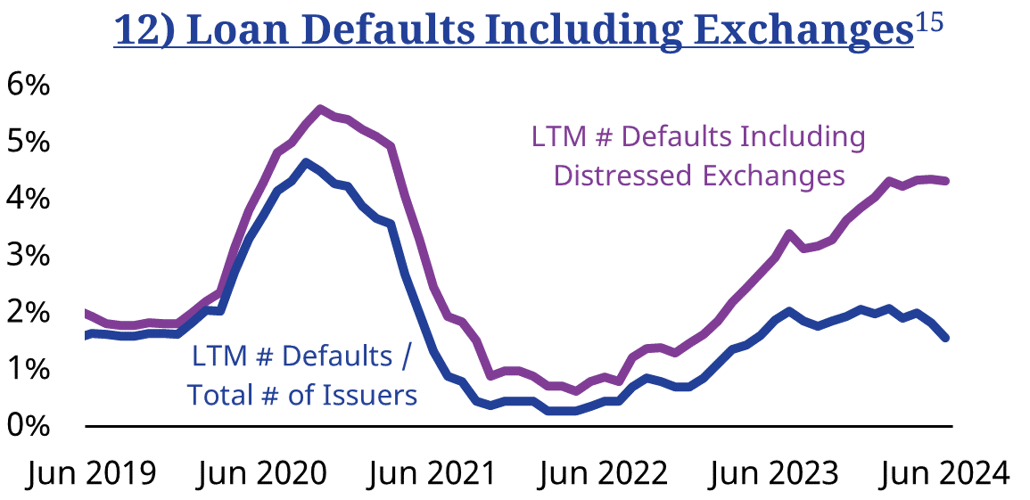

If taken at face value, low default rates might conceal emerging signs of stress in lending markets. For example, companies can pursue out-of-court distressed debt exchanges where loans are restructured at the expense of lenders. Private equity sponsors often favor these exchanges because their equity is preserved and expensive bankruptcy proceedings are avoided. Default rates tell a different story when we adjust for distressed exchanges; the combined rate is 4.22% by issuer count (Graph 12).

It’s important to note that distressed exchanges are less common in the core middle market, where lenders typically have greater protections in place as we discussed earlier. And while default data is less readily available for the core middle market, we posit that the gap between the traditional default rate and combined default rate (as shown above) is much narrower in our segment.

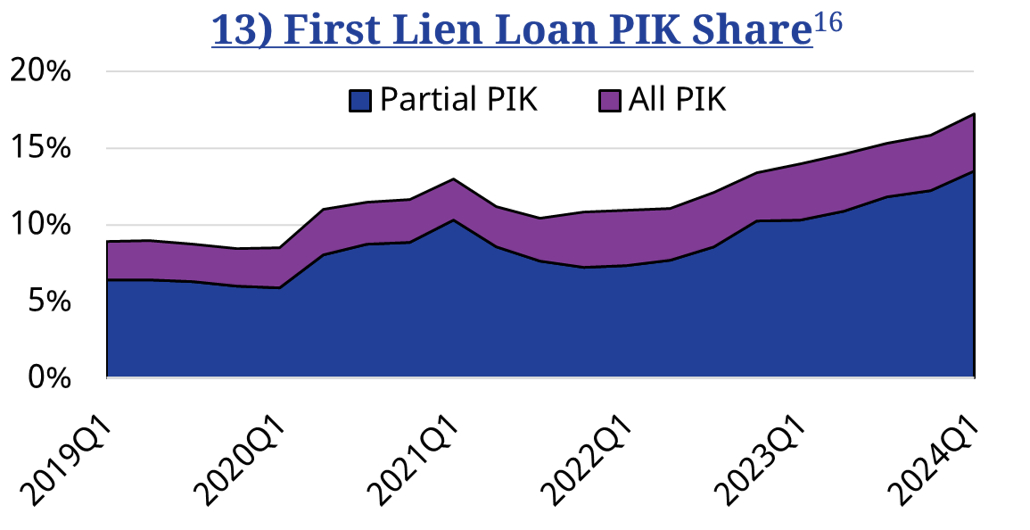

Another way that companies can kick the proverbial default can down the road is to issue paid-in-kind (“PIK”) loans. In short, PIK loans allow borrowers to pay interest with additional debt rather than cash, and may be a warning sign that borrowers are struggling to service their loans with cash flow. A recent report from Raymond James showed that the industry share of first lien loans with partial or full PIK coupons hit an all-time high during the first quarter (Graph 13).

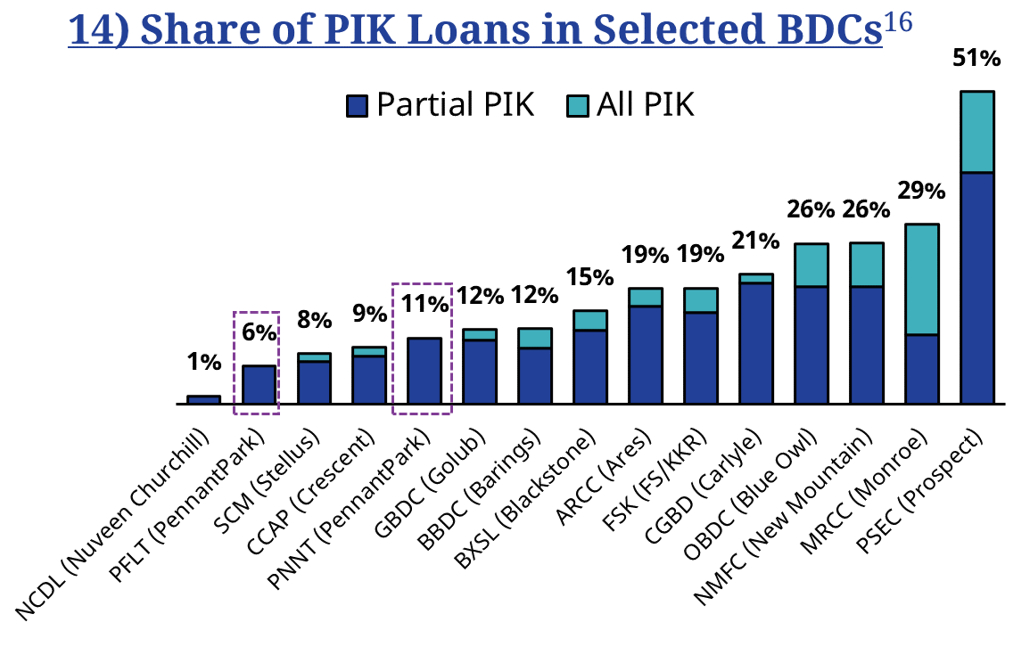

At PennantPark, we prioritize stable and cash-flowing borrowers, and have limited exposure to PIK loans with no all-PIK loans (Graph 14). But savvy investors should be on the lookout for managers leaning into these securities which may portend inevitable defaults.

What to watch in the second half

As a lender, we would love for this Goldilocks environment of broad-based economic growth, high interest rates, and relatively low default rates to continue indefinitely. But we’re not counting on it.

To start, the market expects the Federal Reserve to begin cutting interest rates later this year. The first cut is likely to come in September, with odds favoring a second cut in December. More relevant to our portfolio, SOFR is expected to settle in at a neutral rate under 4.0% (Graph 15). Even though loan yields will decrease correspondingly, we welcome the incremental profits and cash flows that lower rates will afford our portfolio companies. Not to mention that yields of 9% to 10% for first lien loans still compare favorably to other asset classes, as we illustrated above.

Next, we’re optimistic that the resurgence in middle market M&A activity will accelerate into the second half of the year. We’re hearing from sponsors that the pipeline backlog may be loosening in light of a clearer economic picture, readily available debt capital, tighter credit spreads, and the anticipation of lower interest rates. As we discussed above, private equity firms are also feeling pressure to deploy dry powder and monetize long-held investments.

More broadly, there is certainly the chance for increased market volatility as a result of the upcoming presidential election and/or geopolitical tensions overseas. While we don’t make outright bets on the outcomes of political events, we certainly need to be prepared for the repercussions across our portfolio. Fortunately, our private investments in U.S. companies tend to be relatively insulated from disruptions in international trade or volatility in public financial markets. Additionally, supply chains are much more robust than they were before 2020.

Finally, we’re on the lookout for any signs of economic weakness. On the consumer side, recent data points suggest that hiring is slowing, unemployment is rising, and wage growth is decelerating. And although corporate earnings have been strong, the rally in technology stocks may have masked weakness in other sectors.

Whether we ultimately experience a consumer-led slowdown or achieve a soft landing, we feel confident in our portfolio. We continue to target stable and cash flowing borrowers with limited exposure to cyclical end markets; make loans with attractive yields and conservative debt metrics; and secure financial covenants on our directly originated loans.

The data suggests that not all credit managers are acting with the same prudence. In the end, we believe that outperformance in private credit is the result of loss avoidance more so than upside potential, a lesson that new entrants and overzealous managers may learn the hard way if the economic cycle turns. With that in mind, we encourage investors to carefully assess their private credit exposures in light of recent trends, and remember that manager selection matters more than ever as strategies diverge.

We welcome a conversation; please click the button below to get in touch with us.

©2024 PennantPark Investment Advisers, LLC (‘PennantPark’) is an investment adviser registered with the US Securities and Exchange Commission (‘SEC’). Registration is not an endorsement by the SEC nor an indication of any specific level of skill. Products or services referenced in this document may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document, or the merits of the products and services referenced herein. This document and the information contained herein has been made available in accordance with the restrictions and/or limitations implemented by applicable laws and regulations.

In considering the past performance information contained herein, recipients should bear in mind that past performance is not a guarantee, projection or prediction and it is not a guarantee or indication of future results. Invested capital is at risk. There can be no assurance that any product or service referenced herein will achieve comparable results, or that they will be able to implement their investment strategies or achieve their investment objectives.

An investment with PennantPark in any advised fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period. There can be no assurance that any investment will be profitable, not lose money, or achieve the other intended purposes for which they are made. Investing with PennantPark will expose the investor to various risks including, but not limed to, the following: 1) Lack of Liquidity Risks including lack of permitted withdrawals, lack of secondary market, and lack of transferability 2) Interest Rate Volatility Risks 3) Use of Leverage Risks 4) Securitization Risks 5) Credit Market Disruption Risks 6) Investing within a Highly Competitive Market Risks 7) Default by Borrowers Risks 8) Recovery on Bad Debt Risks including cost of recovery 9) International Market Exposure Risks 10) Inflation and Deflation Exposure Risks. This is not intended to be a complete description of the risks of investing with PennantPark. Investors should rely on their own examination of the potential risks and rewards. The firm brochure (Form ADV 2A) is available online at www.adviserinfo.sec.gov or upon request and discusses these and other important risk factors and considerations that should be carefully evaluated before making an investment.

This document is directed at and intended for sophisticated investors. The information contained here does not constitute, and is not intended to constitute, an offer of securities and accordingly should not be construed as such. Information in this document does not constitute legal, tax, or investment advice. Before acting on any information in this document, current and prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions or obtain independent tax, legal, or investment advice.

Statements in this document are made as of the date hereof unless stated otherwise herein, and neither the delivery of this Document at any time, nor any sale hereunder, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. PennantPark believes that such information is accurate and that the sources from which it has been obtained are reliable. PennantPark cannot guarantee the accuracy of such information, however, and has not independently verified the assumptions on which such information is based. Certain statements contained in this Document, including without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects,” and words of similar import constitute “forward looking statements.” Additionally, any forecasts and estimates provided herein are forward-looking statements. Such statements and other forward-looking statements are based on available information and the views of PennantPark as of the date hereof. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results and events may differ materially from those in any forward-looking statements. Further, any opinions expressed are the current opinions of PennantPark only and may be subject to change, without notice. There is no undertaking to update any of the information in this document. No person has been authorized in connection with this document to give any information or to make any representations other than as contained in this document and, if given or made, such information or representation must not be relied upon as having been authorized by PennantPark Investment Advisers, LLC (“PennantPark”) or PennantPark’s affiliates.

1Source: Pitchbook LCD. Q1 2024 Global Private Market Fundraising Report. Published May 22, 2024.

2Source: Pitchbook LCD. Q1 2024 Global Private Market Fundraising Report. Published May 22, 2024.

3Source: PitchBook LCD. U.S. Credit Markets Quarterly Wrap, Q2 2024. Published July 1, 2024. Data through June 30, 2024.

4Source: PitchBook LCD. U.S. Credit Markets Quarterly Wrap, Q2 2024. Published July 1, 2024. Data through June 30, 2024.

5Source: PitchBook LCD. U.S. Credit Markets Quarterly Wrap, Q2 2024. Published July 1, 2024. Data through May 7, 2024.

6Source: LSEG LPC. Middle Market Connect: The Middle Market Opportunity. Published April 23, 2024. Data through March 31, 2024. Analysis excludes annual recurring revenue (ARR) deals.

7Source: LSEG LPC. Middle Market Connect: The Middle Market Opportunity. Published April 23, 2024. Data through March 31, 2024. Analysis excludes annual recurring revenue (ARR) deals. Middle Market includes issuers with revenues of $500 million and below and a total loan package of $500 million and below. Large Corporates (i.e., non-middle market) include syndicated or direct/clubbed deals that have either borrower revenues or total loan package of $500 million or greater.

8Source: LSEG LPC. Middle Market Connect: The Middle Market Opportunity. Published April 23, 2024. Data through March 31, 2024. Analysis excludes annual recurring revenue (ARR) deals. Middle Market includes issuers with revenues of $500 million and below and a total loan package of $500 million and below. Large Corporates (i.e., non-middle market) include syndicated or direct/clubbed deals that have either borrower revenues or total loan package of $500 million or greater.

9Source: JP Morgan Asset Management. Guide to Alternatives, 2Q 2024. Published May 31, 2024. Additional sources listed: BAML, Bloomberg, Cliffwater, Federal Reserve, FTSE, MSCI, NCREIF, FactSet, and Wells Fargo. Equities and fixed income yields are as of 5/31/2024. Alternative yields are as of 12/31/2023, except U.S. Real Estate which are as of 3/31/2024. Preferreds represented by BAML Hybrid Preferred Securities; Direct Lending represented by Cliffwater Direct Lending Index; U.S. High Yield represented by Bloomberg U.S. Aggregate Corporate High Yield; U.S. Real Estate represented by NCREIF Property Index- ODCE; Global REITs represented by FTSE NAREIT Global REITs; U.S. Equity represented by MSCI USA. Refer to endnote 7 above for the source for syndicated loan yields.

10Source: LSEG LPC. Middle Market Connect: The Middle Market Opportunity. Published April 23, 2024. Data through March 31, 2024. Analysis excludes annual recurring revenue (ARR) deals.

11Source: PitchBook LCD. US Leveraged Loan Index Factsheet. Published March 1, 2024. Data through February 29, 2024.

12Source: LSEG LPC. Middle Market Connect: The Middle Market Opportunity. Published April 23, 2024. Data through March 31, 2024. Upper middle market defined as deal sizes of $100 million to $500 million and borrower revenue of less than $500 million.

13Source: S&P Global Ratings. CreditWeek: Is Covenant-Lite Really a Drag on Loan Recoveries? Published February 22, 2024.

14Source: PitchBook LCD. US Leveraged Loan Default Rates Spreadsheet. Published July 1, 2024. Data through June 30, 2024. Default rate calculated based on last twelve months of defaults by dollar value divided by total index dollars outstanding in the Morningstar LSTA Leveraged Loan Index.

15Source: PitchBook LCD. US Leveraged Loan Default Rates Spreadsheet. Published July 1, 2024. Data through June 30, 2024. Default rate calculated based on last twelve months of defaults by count plus the number of distressed exchanges divided by total number of issuers in the Morningstar LSTA Leveraged Loan Index.

16Source: Raymond James. Business Development Companies | It’s a PIK World Now: Income and Loan Share Grow Again. Published May 30, 2024. Data through March 30, 2024. Data shows the share of first lien loans with full or partial paid-in-kind coupons across Raymond James’s BDC coverage universe. Share of PIK exposure for additional BDCs in Raymond James’ coverage universe is available upon request.

17Source: Bloomberg. Data accessed July 15, 2024. The SOFR forward curve is the market’s projection of SOFR based on SOFR futures contracts.