Trump Follows Through on Campaign Promise with “Liberation Day”

On the day after Donald Trump’s election victory, we sent a note to our investors outlining five key themes for private credit investors to watch. Among them was the potential impact of import tariffs on our portfolio. We wrote in November:

“My message is simple: Make your product here in America and only in America,” Trump said in September when addressing the Economic Club of New York. He has threatened to introduce tariffs of up to 60% on any goods imported from China and at least 10% on all other imports. These costs would be partially or fully passed on to consumers, potentially suppressing the demand for goods.

We expect that large corporations with overseas manufacturing operations and/or international supply chains would bear the brunt of these tariffs. Fortunately, PennantPark primarily targets mid-sized, service-oriented U.S. borrowers where tariffs are less likely to significantly impact pricing or operations.

In cases where our portfolio companies rely on international suppliers, we have made significant progress since the COVID-19 pandemic to ensure that any such supply chains are more flexible and more resilient. We are currently taking inventory of our portfolio companies that rely on international suppliers, and we plan to proactively address any potential tariff-related risks with sponsors and management teams in the coming weeks.

Trump was not bluffing. He signed an executive order on April 2 — dubbed “Liberation Day” by the President — that introduced sweeping tariffs on over fifty nations at rates ranging from 11% to 50%. The tariffs are primarily intended to shrink the U.S. trade deficit on physical goods, which has risen steadily since the 1970s to $1.2 trillion annually (or about 4% of U.S. gross domestic product).2 Notably, tariffs on imports from China have since been raised to 125% following reciprocations, and other countries are rushing to either retaliate or negotiate relief. These tariff escalations may represent the most significant shift in U.S. trade policy since the Smoot-Hawley Tariff Act of 1930.

Even though the President telegraphed his intentions, financial markets reacted sharply to the news. Major U.S. equity indices all plunged at least 10% and long-term Treasury yields whipsawed as investors raced to reposition their portfolios based on constantly evolving headlines. More recently, Trump indicated that many of the tariffs would be paused for 90 days and markets rallied. We expect continued volatility in the coming days.

Amid the public market chaos, we reiterate that our portfolio was built for this moment. After completing a targeted risk assessment, our investment team determined that only 7% of our firmwide portfolio by market value is directly impacted by the newly introduced tariffs. In these cases, we are working with management teams and sponsors to understand the extent to which tariffs may reduce profit margins, whether price increases can be partially or fully passed to end customers, and how supply chains can be adjusted. The remaining 93% of our portfolio is mostly insulated from tariff risk.

We must also consider the indirect consequences of protectionist trade policy. First, the likelihood of an economic recession will continue to increase as long as punitive tariffs remain in place. High policy uncertainty also makes it difficult for businesses and consumers to plan ahead, resulting in decreased spending and adding further economic pressure. Second, monetary policy becomes opaque in a stagflationary environment as the Federal Reserve wrestles with the opposing forces of inflation and rising unemployment. These risks present clear challenges for all credit investors, but there’s nowhere we’d rather be than in the core middle market where our loans feature lower leverage, more equity cushion from private equity sponsors, and important lender protections like financial covenants. As a reminder, we define the core middle market as companies with earnings of $10 million to $50 million (a segment that has been overlooked and underserved by traditional lenders).

As other market participants panic, there may also be opportunities to go on offense. So far trading in liquid credit markets has been orderly, but we stand ready to take advantage if secondary loan prices decouple from fundamental values as they did in 2020 and 2022. Both periods were highly profitable for our Opportunistic Credit funds. Additionally, since private credit tends to be a vintage business, funds deploying capital in late 2025 and 2026 may benefit from improved risk and return dynamics on the back of the current market disruption. Even if new buyout activity remains muted in the coming weeks and months, we expect that our position as incumbent lender to existing borrowers and private equity sponsors will provide meaningful deal flow in the form of add-on acquisitions.

We provide additional details below, and invite our investors to discuss any of these topics in more detail. After all, we receive monthly financial reporting for the vast majority of our 190 portfolio companies, providing us with a bird’s-eye view of the American economy in real time.

We Believe the Core Middle Market is Largely Protected from Tariff Risk

There are several reasons why we believe the U.S. core middle market may be insulated from the first-order impact of tariffs:

A core component of our investment strategy is to focus on cash-flowing companies with asset-lite operations, flexible cost structures, and minimal ongoing capital expenditure requirements. As a result, we gravitate toward industries like healthcare services, government services, software & technology, and business services. These types of companies typically don’t manufacture anything or move goods across borders, instead relying on people and software to generate revenue. If service companies do import goods or materials, they typically account for a small share of operating expenses and price increases can more easily be passed to end customers.

We have also made investments in the consumer segment, although we have pivoted away from consumer goods and toward residential services over the past two years due to our increasing concern regarding consumer spending on discretionary products. We won’t claim that we saw the tariffs coming in 2023, but our portfolio should benefit nonetheless!

Sources of revenue are also overwhelmingly domestic in the core middle market. That means that our borrowers are less susceptible to retaliatory tariffs from other countries. So, while our motivations are motivated by capitalism rather than patriotism, our investment strategy conforms to President Trump’s mandate calling for domestic production matched with domestic sales.

Finally, we note that many of portfolio companies learned valuable lessons during the COVID-19 pandemic. Namely, any companies that rely on overseas supply chains diversified their sourcing to decrease reliance on China. This increased flexibility will prove valuable if the Trump Administration continues to apply pressure on China while negotiating more constructive solutions with America’s other trade partners.

Limited Tariff Exposure Across the PennantPark Portfolio

As we referenced in November, our investment team conducted a detailed risk assessment to better understand the potential impact of tariffs on our portfolio companies. In summary, only 7% of the portfolio by market value was deemed meaningfully impacted by the recently introduced import tariffs. These companies are mostly legacy consumer goods investments with overseas manufacturing operations.

Additional companies may have some exposure through increased cost of raw materials, supplies, or equipment. We deemed these investments as “Limited” or “Somewhat” impacted. For example, a healthcare services company may import imaging devices from Germany or medical supplies from Mexico. While such expenses may account for a small portion of the company’s total expenses, there may still be an impact to profit margins and cash flows.

Additional companies may have some exposure through increased cost of raw materials, supplies, or equipment. We deemed these investments as “Limited” or “Somewhat” impacted. For example, a healthcare services company may import imaging devices from Germany or medical supplies from Mexico. While such expenses may account for a small portion of the company’s total expenses, there may still be an impact to profit margins and cash flows.

Having mapped the tariff risk exposures across the active portfolio, our attention has now turned to risk mitigation in partnership with management teams and private equity sponsors. Based on recent conversations, we expect some companies to shift supply chains to geographies with lower expected tariffs. Additionally, increased costs can be shared with suppliers or passed on to customers to protect margins. In the immediate term, some companies may also accelerate inventory purchases during the ongoing 90-day moratorium on most import tariffs.

Conservative Loan Structures Provide Margin of Safety

Our leading priority as a lender is to protect and preserve investor capital. This requires disciplined underwriting and loan structuring even as other lenders relax their standards to win business. Fortunately, our value-added industry expertise, structuring flexibility, and longstanding relationships with private equity sponsors help us win business even when we aren’t the lowest cost of capital.

As we highlighted in a recent investor letter, we maintained conservative average debt metrics on new investments throughout 2024 including a 3.8x leverage multiple, 42% loan-to-value ratio, 2.4x interest coverage ratio, and financial covenants on virtually all directly originated new first lien loans.

For the layperson, these metrics imply that the enterprise value of our average borrower could decline by 58% before our investment principal is impaired. Likewise, our average borrower could experience a 55% decline in earnings and still be able to cover the interest payments on our loans. That margin of safety gives us confidence that our portfolio is well positioned for any market environment.

PennantPark’s 18-Year Track Record Through Challenging Markets

PennantPark has been investing through cycles since 2007 including the Global Financial Crisis (“GFC”), COVID-19 pandemic, and countless industry-specific challenges in between. And our senior investment professionals have been active in lending markets going back to the 1980s. We’re proud of our track record through these difficult periods, and believe that experience gained and lessons learned have made us better investors each time. Importantly, we have been around long enough to understand that outperformance in private credit is the result of loss avoidance more so than upside potential, a lesson that new entrants may learn the hard way if the economic cycle finally turns.

Potential Opportunities Ahead

As we discussed above, our primary concern during challenging markets is to protect capital. But as other market participants panic, there may be opportunities to go on offense. There have already been some signs of weakness in liquid credit markets as the LSTA Leveraged Loan Index dropped to $95.08 earlier this week from $97.33 at the beginning of the year.5 Despite the movement, trading has been orderly to this point and we haven’t yet seen any signs of true panic or dislocation. We stand ready to step in if and when our investment criteria are met.

Secondary investments have been an important and successful component of our Opportunistic Credit strategy in the past, especially during broad-based selloffs driven by general economic uneasiness or technical flows. We seek performing, cash flowing credits in defensive industries where the market price of a loan has dislocated from the company’s fundamental value.

Importantly, we’re entering at attractive entry multiples of generally 4.5x or lower with customary first lien structural protections. PennantPark may also have an information advantage from a current or past investment, previous due diligence, or investing in a close competitor or supplier. We believe that there will be a “pull to par” for many of these investments if market stabilize and the issuers perform well, leading to unlevered gross returns in the mid-teens over a two to three-year holding period.

This approach paid off in 2020 and 2022, significantly boosting returns in our Opportunistic Credit funds. In fact, secondary market investments have been a key driver of PCOF IV’s net returns to date of +16.8% through year end. In that fund, capital gains have accounted for 24% of gross returns thanks in large part to buying low and selling high during the market volatility of 2022 caused by increasing interest rates.

Additionally, market volatility may be a catalyst for more favorable risk and return dynamics after credit spreads have grinded tighter over the past eighteen months. This could present attractive primary market opportunities for private credit funds deploying capital in late 2025 and 2026. And even if buyout activity is slow, a large portion of PennantPark’s deal flow comes from add-on acquisitions from existing borrowers. Growing with our borrowers in this way is a key component of our value proposition as a strategic lender.

So while we certainly wouldn’t mind a continuation of the high interest rates and low defaults that defined the past two years, we remind our investors that in the midst of chaos, there is also opportunity.

The material included in this publication is confidential and is intended for informational purposes only. This letter may not be reproduced and may not be redistributed to any party without prior written consent. It is neither advice nor a recommendation to enter into any transaction and is not an offer to buy or sell any security. Any offer or solicitation may only be made by delivery of the private placement memorandum of the respective fund.

The views, opinions, and assessments expressed in this letter reflect the current thinking of PennantPark Investment Advisers, LLC and are based on information available at the time of writing. These statements are intended solely to provide context regarding the firm’s current investment strategy and portfolio composition. They do not constitute predictions or guarantees of future performance and may not be applicable to other market segments, investment approaches, or time periods. Actual outcomes may differ materially due to a variety of economic, market, and company-specific factors.

This document may contain forward-looking statements, including opinions, projections, and expectations regarding future events or performance. These statements are inherently uncertain, are based on current assumptions, and involve risks and uncertainties that could cause actual outcomes to differ materially.

While certain parallels can be drawn from prior economic or market cycles, no historical period offers a precise predictor of future outcomes. Conditions impacting future performance may differ materially from those observed in the past.

Past performance is not indicative of, or a guarantee of, future results. Actual results may vary, and there is no assurance that historical performance—whether during prior market disruptions or economic cycles—will be replicated.

Statements of fact or analysis provided herein are based on internal assessments unless otherwise noted. While believed to be accurate and current, they may be based on incomplete data and are subject to change without notice.

The performance return and attribution estimated figures represented herein are preliminary and unaudited. Individual portfolio company performance should not be considered representative of all portfolio companies held by a fund, and there can be no assurance that future investments will produce similar results.

Specific investments described herein do not represent all investment decisions made by PennantPark. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future.

An investment in the interests of any PennantPark fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period of time. There can be no assurance that any investments will be profitable, not lose money, or achieve the other intended purposes for which they are made. In particular, the risks of investing in such funds may include: 1) Lack of liquidity in that withdrawals are generally not permitted, and there is no secondary market for Interests and none is expected to develop; 2) Restrictions on transferring Interests; 3) The use of leverage; and 4) Less regulation and higher fees than mutual funds. This is not intended to be a complete description of the risks of investing in such funds. Investors should rely on their own examination of the potential risks and rewards. Prospective investors should consult with their own legal, tax, and financial advisers as to the consequences of an investment.

The investment strategies and portfolio composition described herein may be modified in the future by PennantPark Investment Advisers, LLC (“PennantPark”) in its sole discretion at any time and without further notice to investors in response to changing market conditions, or in any manner it believes is consistent with the overall investment objective of the respective funds.

The opinions expressed herein represent the general observations of PennantPark management regarding macroeconomic and financial market performance during the applicable period. This document contains forward-looking statements based upon certain assumptions. All information has been obtained from sources believed to be reliable and current, but accuracy cannot be guaranteed.

The performance return and attribution estimated figures represented herein are preliminary and unaudited. Past performance is no indication of future performance. Individual portfolio company performance should not be considered representative of all portfolio companies held by a fund, and there can be no assurance that future investments will produce similar results.

Specific investments described herein do not represent all investment decisions made by Pennant Park. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment advice references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future.

An investment in the interests of any PennantPark fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period of time. There can be no assurance that any investments will be profitable, not lose money, or achieve the other intended purposes for which they are made. In particular, the risks of investing in such funds may include: 1) Lack of liquidity in that withdrawals are generally not permitted, and there is no secondary market for Interests and none is expected to develop; 2) Restrictions on transferring Interests; 3) The use of leverage; and 4) Less regulation and higher fees than mutual funds. This is not intended to be a complete description of the risks of investing in such funds. Investors should rely on their own examination of the potential risks and rewards. Prospective investors should consult with their own legal, tax, and financial advisers as to the consequences of an investment.

The investment strategies and portfolio composition described herein may be modified in the future by PennantPark Investment Advisers, LLC (“PennantPark”) in its sole discretion at any time and without further notice to investors in response to changing market conditions, or in any manner it believes is consistent with the overall investment objective of the respective funds.

Endnotes:

A tariff risk assessment was conducted by PennantPark’s investment team and updated April 10, 2025. Exposures were measured based on market values of investments. The following definitions were used for each tariff risk rating category: 5 – Highest Risk (supply chain >95% exposed to tariff-impacted regions), 4 – Directly Impacted (supply chain 75%-95% exposed to tariff-impacted regions), 3 – Somewhat Impacted (supply chain 50%-75% exposed to tariff-impacted regions), 2 – Limited Impact (supply chain 25%-50% exposed to tariff-impacted regions), 1 -Minimal / No Impact (supply chain <25% exposed to tariff-impacted regions). Ratings may also take into account the impact that tariffs are likely to have on each company’s operating expenses and, therefore, profit margins.

Source: U.S. Bureau of Economic Analysis: U.S. International Trade in Goods and Services December and Annual 2024. Published February 5, 2025.

Performance based on all investments across the PennantPark platform and excludes revolvers and non-core Investments (i.e. those related to the PNNT IPO). Vintage is based on first date of investment for each deal; follow-on investments grouped with initial investments. GlobalFinancial Crisis (“GFC”) defined as 2007-2009 vintage investments. Historical gross returns for the GFC and equity co-investments are calculated based on actual investment-level cash flows. Estimated net returns are calculated by reducing the gross returns by pro forma management fees, fund expenses, and incentive fees based on the proposed terms of PennantPark’s most recent fund offerings. Please refer to the Important Notices for detailed assumptions underlying the net return estimates.

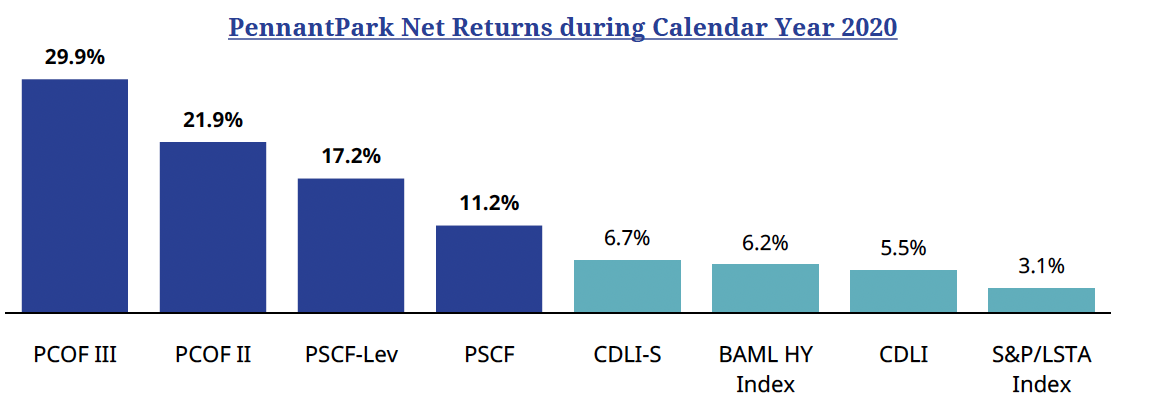

PCOF II, PCOF III, PSCF, and PSCF-Lev returns presented above are net returns from 1/1/2020 through 12/31/2020. Net returns are calculated after subtracting management and incentive fees. Market Data Source: LCD, an offering of S&P Global Market Intelligence and Cliffwater LLC; Cliffwater Direct Lending Index – Senior (“CDLI-S”) and Cliffwater Direct Lending Index (“CDLI”).

Source: Pitchbook LCD Morningstar LSTA Leverage Loan Index Levels Spreadsheet.