I. Portfolio Company Leverage (DEBT/EBITDA)

Managing debt-to-EBITDA1 ratios, or portfolio company leverage, is critical for assessing a company’s financial health. This ratio helps evaluate a company’s financial ability—or inability—to satisfy its debt obligations. A higher leverage ratio may indicate increased default risk, as companies with substantial debt relative to earnings could face challenges in servicing their debt obligations, particularly during periods of economic stress.

Conversely, a lower leverage ratio could indicate more manageable debt levels relative to earnings, which can contribute to financial stability under many market conditions. Companies with lower leverage may have a greater capacity to service debt, including interest and principal payments.

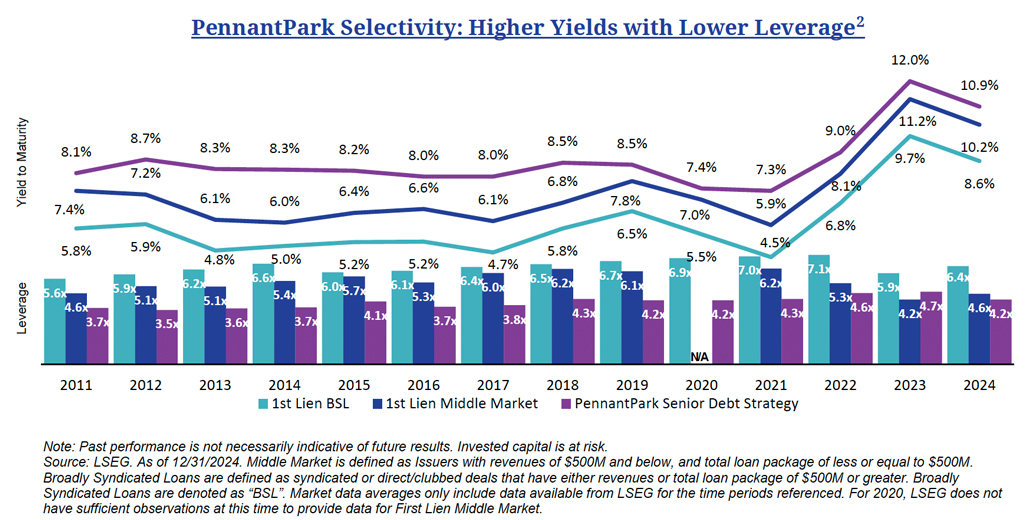

At PennantPark, we focus on lending to companies with manageable leverage, ensuring they generate sufficient operating cash flows to meet their debt obligations, even during economic slowdowns. We typically target leverage multiples of 4.0x to 5.0x for first lien loans, whereas upper middle market managers generally target leverage multiples of 5.0x to 7.5x for first lien loans.

By focusing on conservative leverage multiples, we seek to manage risk during downturns when portfolio companies may face balance sheet pressures. Additionally, PennantPark underwrites each potential investment to recessionary downside scenarios. Our stress test models include, but are not limited to, the following factors:

II. Fund-Level Leverage (Asset-backed credit facility)

Fund-level leverage represents the amount of borrowing a private credit fund undertakes relative to its net asset value (NAV). Essentially, this measures how much debt the fund itself is using to finance its investments. A higher fund-level leverage ratio means the fund is borrowing a larger proportion of its capital, which can amplify both potential returns and risks. During economic downturns, fund-level leverage may magnify losses, as higher debt levels can increase liquidity pressures, potentially leading to asset sales at unfavorable prices.

Key Considerations of Fund-Level Leverage During Economic Downturns:

The use of fund-level leverage must be carefully managed to ensure the fund maintains flexibility and avoids taking on excessive risk. PennantPark employs a disciplined approach to fund-level leverage, striking a balance between leveraging facilities for growth and safeguarding against liquidity risks in challenging market conditions.

PennantPark is an independent middle market credit platform founded in 2007 by private credit industry veteran Art Penn (Co-Founder and former Managing Partner at Apollo Credit). As of 2025, PennantPark has invested over $26 billion in over 780 private credit transactions since its inception. Our clients include some of the world’s largest and most sophisticated institutional investors. We are in the process of expanding our offerings to focus on the private wealth market. The Firm is headquartered in Miami and has additional offices in New York, Chicago, Houston, Los Angeles, and Amsterdam. PennantPark primarily invests in the core middle market, defined as companies with earnings of $10 million to $50 million. Our industries of focus include business services, government services, healthcare, consumer, and software/technology. PennantPark offers investment strategies through various public and private fund structures, including BDCs, LP drawdown vehicles, CLOs, SMAs, and joint ventures.

©2025 PennantPark Investment Advisers, LLC (‘PennantPark’) is an investment adviser registered with the US Securities and Exchange Commission (‘SEC’). Registration is not an endorsement by the SEC nor an indication of any specific level of skill. Products or services referenced in this document may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document, or the merits of the products and services referenced herein. This document and the information contained herein has been made available in accordance with the restrictions and/or limitations implemented by applicable laws and regulations.

In considering the past performance information contained herein, recipients should bear in mind that past performance is not a guarantee, projection or prediction and it is not a guarantee or indication of future results. Invested capital is at risk. There can be no assurance that any product or service referenced herein will achieve comparable results, or that they will be able to implement their investment strategies or achieve their investment objectives.

The information herein reflects PennantPark’s investment approach at the time of publication but does not guarantee specific outcomes. Leverage levels, underwriting processes, and risk assessments are subject to change and may vary across investments. Leverage may magnify both gains and losses, and past strategies are not indicative of future performance or risk mitigation. Investing involves risk, including market fluctuations, liquidity constraints, regulatory considerations, and the potential loss of principal. Investors should carefully assess all associated risks before making investment decisions.

An investment with PennantPark in any advised fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period. There can be no assurance that any investment will be profitable, not lose money, or achieve the other intended purposes for which they are made. Investing with PennantPark will expose the investor to various risks including, but not limited to, the following: 1) Lackof Liquidity Risks including lack of permitted withdrawals, lack of secondary market, and lack of transferability 2) Interest Rate Volatility Risks 3) Use of Leverage Risks 4) Securitization Risks 5) Credit Market Disruption Risks 6) Investing within a Highly Competitive Market Risks 7) Default by Borrowers Risks 8) Recovery on Bad Debt Risks including cost of recovery 9) International Market Exposure Risks 10) Inflation and Deflation Exposure Risks. This is not intended to be a complete description of the risks of investing with PennantPark. Investors should rely on their own examination of the potential risks and rewards. The firm brochure (Form ADV 2A) is available online at www.adviserinfo.sec.gov or upon request and discusses these and other important risk factors and considerations that should be carefully evaluated before making an investment.

This document is directed at and intended for sophisticated investors. The information contained here does not constitute, and is not intended to constitute, an offer of securities and accordingly should not be construed as such. Information in this document does not constitute legal, tax, or investment advice. Before acting on any information in this document, current and prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions or obtain independent tax, legal, or investment advice.

Statements in this document are made as of the date hereof unless stated otherwise herein, and neither the delivery of this Document at any time, nor any sale hereunder, shall under any circumstances create an implication that the information contained herein is correct as of anytime after such date. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. PennantPark believes that such information is accurate and that the sources from which it has been obtained are reliable. PennantPark cannot guarantee the accuracy of such information, however, and has not independently verified the assumptions on which such information is based. Certain statements contained in this Document, including without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects,” and words of similar import constitute “forward looking statements.” Additionally, any forecasts and estimates provided herein are forward-looking statements. Such statements and other forward-looking statements are based on available information and the views of PennantPark as of the date hereof. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results and events may differ materially from those in any forward-looking statements. Further, any opinions expressed are the current opinions of PennantPark only and may be subject to change, without notice. There is no undertaking to update any of the information in this document. No person has been authorized in connection with this document to give any information or to make any representations other than as contained in this document and, if given or made, such information or representation must not be relied upon as having been authorized by PennantPark Investment Advisers, LLC (“PennantPark”) or PennantPark’s affiliates.