Key Drivers Behind Private Credit’s Growth:

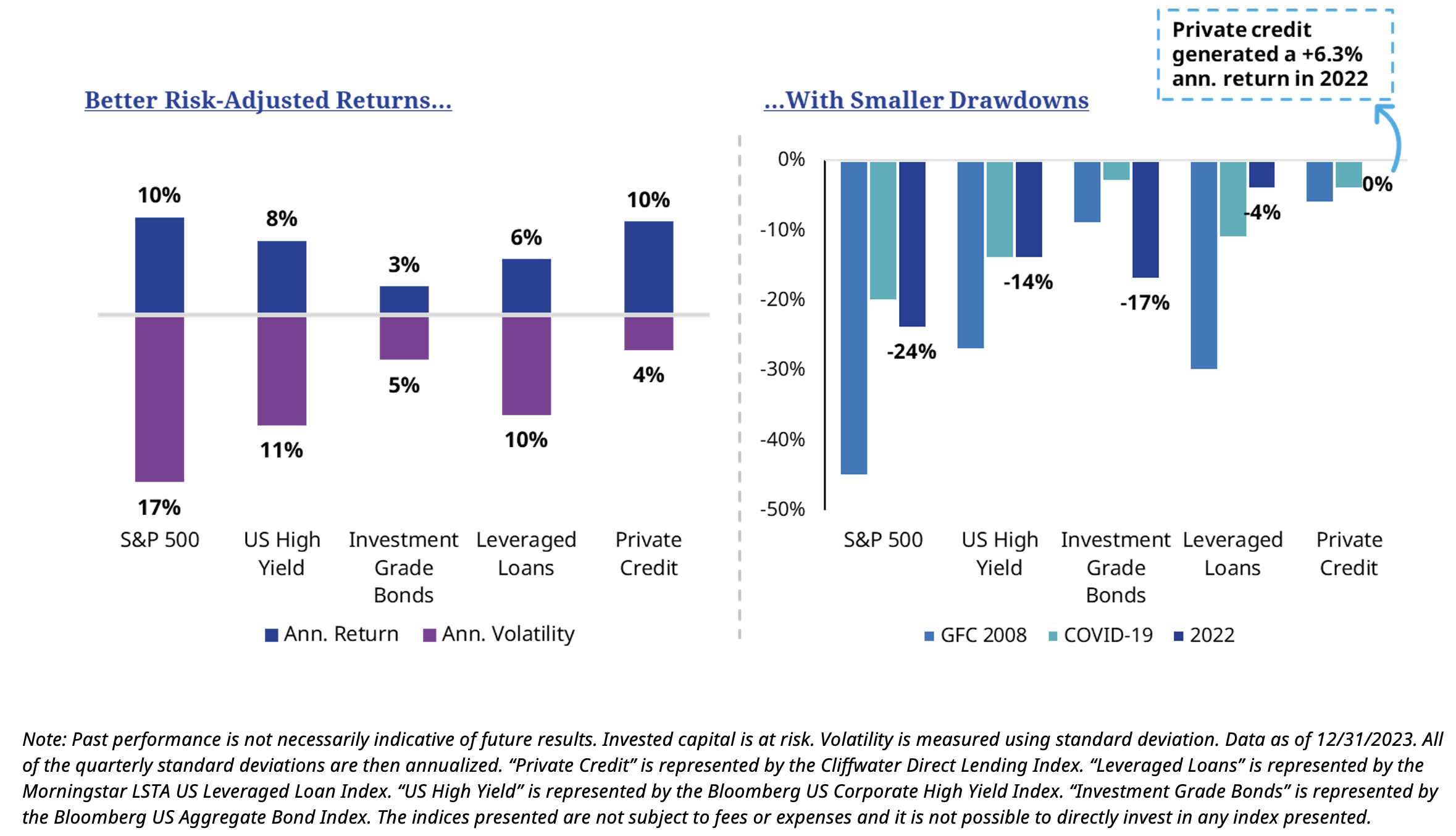

Historically, private credit has been an attractive investment ripe with growth opportunities fueled by attractive risk-adjusted returns — even during periods of economic uncertainty and market volatility.

However, as regulators force banks to continue to tighten lending practices and private credit becomes a more sought-after investment class, investors are increasingly wondering whether it’s become overfunded, creating the perception that it’s too risky.

At PennantPark, we believe the opposite to be true. This article argues why private credit is not overfunded and discusses what investors and borrowers should consider when evaluating investment opportunities.

Growing Demand from Middle Market Borrowers

Middle market demand for private credit is not slowing down anytime soon for three key reasons:

Since the Global Financial Crisis (GFC) and the introduction of new regulations, banks have continually pulled back on lending. These regulations require banks to hold more capital on their balance sheets to protect against defaults and loan repayment failures, but that tends to leave middle market borrowers out to dry.1

Private credit stepped up to fill this void left by banks. As a result, middle market companies, especially those backed by private equity sponsors, are increasingly turning to private credit.

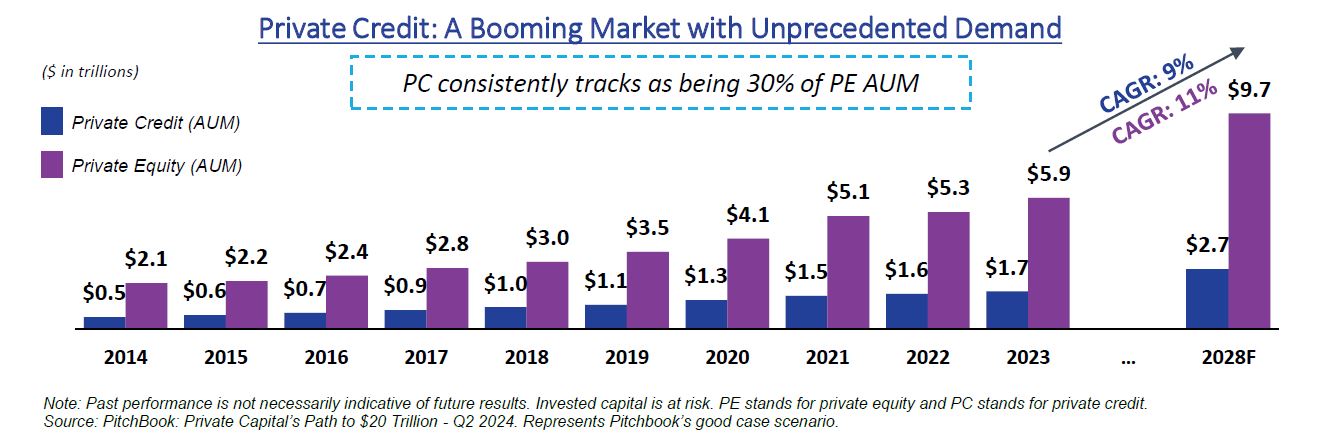

At the end of 2023, private credit AUM was $1.7 trillion. According to Pitchbook, the private debt market will grow to $2.7 trillion by 2028.2 These estimates suggest that non-bank lending will remain robust, and private credit funds will continue to play a critical role in meeting this need.

At the same time, specific industry sectors in the middle market continue to demonstrate resilient growth, making private credit an attractive and sustainable investment.

At PennantPark, we focus on serving the “core” middle market (earnings of $10 to $50 million) across five defensive sectors: healthcare, government services, business services, consumer, and software and technology.

The Bureau of Labor Statistics projects these sectors to experience demonstrable wage and salary growth over the next decade.3 This projected labor market growth could indicate that capital inflows into private credit are aligned with where the market is experiencing sustainable growth.

Finally, this growth in demand from middle market borrowers is primarily fueled by companies’ desire to remain private longer. In fact, we’ve witnessed a 47% decline in the number of public companies trading on the market, dropping from around 8,000 to just over 4,000 total publicly traded companies since the 1990s.4 More middle market companies are turning to private equity firms to seek the capital they need to fuel future growth rather than the public markets.

Pitchbook projects private equity to grow to $9.7 trillion in the next five years, potentially propelling private credit to $2.7 trillion.5

Today, direct lenders like PennantPark make up 82% of PE-backed loans, an increase from under 30% 30 years ago.5 As private equity and private credit are expected to grow in parallel, this would indicate that the capital allocated to private credit isn’t excessive but essential to serving this market segment.

An All-Weather Asset Class

Historically, private credit is considered an all-weather asset class.

Private credit markets can weather volatile market conditions better than public markets. After all, private credit’s lower correlation to traditional asset classes helps protect against market downturns and ensure stability throughout different economic cycles.

Additionally, private credit is less sensitive to changes in macroeconomic conditions, like high inflation, than traditional investment classes. Because private credit is often structured on floating interest rates, it acts like a built-in hedge against high inflation. As rates controlled by central banks rise, so do private credit loan interest rates, making private credit a more attractive option than other investments that are more negatively affected by high inflationary environments.

Therefore, investors looking for capital preservation and contractual long-term returns may find the dependability they seek in private credit, making the asset class a highly sought-after investment option.

Private Credit is Not Overfunded

While fear of overfunding private credit is understandable due to increased competition and recent spread tightening, the above factors support our claim that private credit is not overfunded.

After all, demand for private credit is clearly growing. As of the end of 2023, the global private credit market was valued at nearly $2 trillion, approximately ten times its size in 20096, and demand for funding continues to surpass supply.

Additionally, private credit provides an opportunity to capitalize on equity-like returns with less risk than traditional asset classes. For example, while private credit generated a 6.3% annual return in 2022, the S&P 500 fell 24%, demonstrating resilience while other investments struggled.

Finally, as the economy reacts to the news of President Trump’s re-election, we’re beginning to get a clearer picture of how changing macroeconomic conditions could impact the outlook for private credit. Potential higher-for-longer interest rates, tax cut expectations, and government spending could create opportunities for private lenders to step in and provide much-needed funding in a favorable business environment.

©2024 PennantPark Investment Advisers, LLC (‘PennantPark’) is an investment adviser registered with the US Securities and Exchange Commission (‘SEC’). Registration is not an endorsement by the SEC nor an indication of any specific level of skill. Products or services referenced in this document may not be licensed in all jurisdictions, and unless otherwise indicated, no regulator or government authority has reviewed this document, or the merits of the products and services referenced herein. This document and the information contained herein has been made available in accordance with the restrictions and/or limitations implemented by applicable laws and regulations.

In considering the past performance information contained herein, recipients should bear in mind that past performance is not a guarantee, projection or prediction and it is not a guarantee or indication of future results. Invested capital is at risk. There can be no assurance that any product or service referenced herein will achieve comparable results, or that they will be able to implement their investment strategies or achieve their investment objectives.

An investment with PennantPark in any advised fund is suitable only for sophisticated investors and requires the financial ability and willingness to accept the risks and lack of liquidity that are characteristic of an investment in such funds. Investors must be prepared to bear such risks for an extended period. There can be no assurance that any investment will be profitable, not lose money, or achieve the other intended purposes for which they are made. Investing with PennantPark will expose the investor to various risks including, but not limed to, the following: 1) Lack of Liquidity Risks including lack of permitted withdrawals, lack of secondary market, and lack of transferability 2) Interest Rate Volatility Risks 3) Use of Leverage Risks 4) Securitization Risks 5) Credit Market Disruption Risks 6) Investing within a Highly Competitive Market Risks 7) Default by Borrowers Risks 8) Recovery on Bad Debt Risks including cost of recovery 9) International Market Exposure Risks 10) Inflation and Deflation Exposure Risks. This is not intended to be a complete description of the risks of investing with PennantPark. Investors should rely on their own examination of the potential risks and rewards. The firm brochure (Form ADV 2A) is available online at www.adviserinfo.sec.gov or upon request and discusses these and other important risk factors and considerations that should be carefully evaluated before making an investment.

This document is directed at and intended for sophisticated investors. The information contained here does not constitute, and is not intended to constitute, an offer of securities and accordingly should not be construed as such. Information in this document does not constitute legal, tax, or investment advice. Before acting on any information in this document, current and prospective investors should inform themselves of and observe all applicable laws, rules and regulations of any relevant jurisdictions or obtain independent tax, legal, or investment advice.

Statements in this document are made as of the date hereof unless stated otherwise herein, and neither the delivery of this Document at any time, nor any sale hereunder, shall under any circumstances create an implication that the information contained herein is correct as of any time after such date. Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. PennantPark believes that such information is accurate and that the sources from which it has been obtained are reliable. PennantPark cannot guarantee the accuracy of such information, however, and has not independently verified the assumptions on which such information is based. Certain statements contained in this Document, including without limitation, statements containing the words “believes,” “anticipates,” “intends,” “expects,” and words of similar import constitute “forward looking statements.” Additionally, any forecasts and estimates provided herein are forward-looking statements. Such statements and other forward-looking statements are based on available information and the views of PennantPark as of the date hereof. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties. Actual results and events may differ materially from those in any forward-looking statements. Further, any opinions expressed are the current opinions of PennantPark only and may be subject to change, without notice. There is no undertaking to update any of the information in this document. No person has been authorized in connection with this document to give any information or to make any representations other than as contained in this document and, if given or made, such information or representation must not be relied upon as having been authorized by PennantPark Investment Advisers, LLC (“PennantPark”) or PennantPark’s affiliates.

1: Source: The way companies borrow money is changing forever. Business Insider

2: Source: PitchBook: Private Capital’s Path to $20 Trillion – Q2 2024. Represents Pitchbook’s good case scenario.

3: Source: Industry and occupational employment projections overview and highlights, 2023–33, Bureau of Labor Statistics

4: Source: World Federation of Exchanges, World Bank, PitchBook. U.S. Census Bureau.

5: Source: PitchBook: Private Capital’s Path to $20 Trillion – Q2 2024. Represents Pitchbook’s good case scenario.

6: Source: McKinsey & Company. McKinsey’s Private Markets Annual Review 2023. McKinsey & Company, 2023, www.mckinsey.com/industries/private-capital/our-insights/mckinseys-private-markets-annual-review-2023.

7: Source: LSEG LPC’s Middle Market Connect The Middle Market Opportunity, 2Q-2024. PitchBook LCD, Dec 31, 1994 – Dec 2022.